Forex News

Societe Generale’s Kunal Kundu reviews India’s FY27 Union Budget, highlighting policy continuity and fiscal consolidation in a context of geopolitical strains and currency weakness. The note flags modest allocations to employment schemes, questions execution of six focus areas, and warns that without stronger revenues, capital expenditure may again be cut to meet the 4.3% of GDP deficit target.

Fiscal consolidation but capex at risk

"Amid geopolitical strains, trade uncertainty, currency weakness, and investor scepticism over growth metrics, India’s FY27 Union Budget presented on 1 February 2026, emphasised policy continuity and fiscal consolidation."

"Among the various announcements, focus on data centres and GCCs (Global Capability Centres) would likely provide a major tailwind to one of India’s important growth drivers as will the ramping up of support for India’s nuclear energy programme."

"The budget proposed six major focus areas. However, implementation gaps remain keys areas of concern for India’s ability to meet its stated targets."

"Despite a stated focus on employment since 2024, allocations for employment generation schemes have been modest – and actual spending even more so."

"If the FY27 deficit target is prioritised without stronger revenues, capex could again become the adjustment lever."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

- GBP/USD falls after core PPI jumps to 3.6%, supporting a less dovish Federal Reserve outlook.

- Middle East tensions linked to Donald Trump add safe-haven bid to the US Dollar.

- Political pressure on Keir Starmer and BoE cut odds cap Sterling rebounds.

The Pound Sterling (GBP) drops some 0.10% on Friday as the Greenback is underpinned by a hot inflation report in the US, which prompted investors to price in a less dovish Federal Reserve (Fed). Also heightened risks in the Middle East weighed on the GBP/USD pair, which trades at 1.3469 at the time of writing.

Sterling eases as firm US inflation data tempers Fed cut bets and risk sentiment deteriorates

Risk appetite has taken a toll as the AI hype seems to have faded, as depicted by the S&P 500, which is headed towards its worst month since March 2025. In the US, the core Producer Price Index (PPI) in January exceeded estimates of 3%, expanding by 3.6% YoY, up from 3.3% in December. Headline PPI dipped from 3% to 2.9% YoY but missed forecasts for a more pronounced drop to 2.6%.

Even though inflation jumped —due to tariffs as the PPI suggests that trade services rose 2.5%, expectations that the Federal Reserve will reduce rates remain unchanged. Money markets are projecting 56 basis points of easing towards the year-end, according to Prime Market Terminal data.

Geopolitical risks are increasing

Tensions in the Middle East remain high, amid growing speculation that the US authorized the departure of some embassy personnel and families in Israel and Baghdad.

US President Donald Trump said that he hasn’t decided on Iran but stressed that he is not happy with how they negotiate. When asked about using military force, he said, “I don’t want to, but sometimes you have to.”

Across the pond, local elections are exerting pressure on Prime Minister Keir Starmer. Britain’s left-wing Green Party won in an area of Manchester mostly dominated by Starmer’s Labour Party for almost a century.

So far, the GBP has shrugged off domestic political turmoil surrounding Starmer, capped by hawkish comments by Bank of England (BoE) Chief Economist Huw Pill. He commented that declines in headline inflation caused by temporary factors should not create a false sense of safety.

Nevertheless, money markets odds for a BoE rate cut in March remain at 84%, with the UK central bank expected to reduce rates by 25 basis points.

Next week, UK/US economic calendar

The UK economic docket will be light, with a speech by BoE David Ramsden. In the US, the schedule is busy, with the release of the ISM Manufacturing and Services PMI, Fed speeches, Retail Sales and Nonfarm Payrolls.

GBP/USD Price Forecast: Technical outlook

In the daily chart, GBP/USD trades at 1.3470. Price action sits between an ascending support trend line from 1.3035 and a descending resistance line from 1.3869, leaving the near-term bias neutral with a slight downside tilt as the pair holds below the latter. The cluster of simple moving averages around 1.3500 caps upside attempts, indicating a fading bullish impulse after the mid-month highs near 1.3800. At the same time, the still-rising longer averages and intact rising trend line argue against an outright bearish call, framing current trade as consolidation within a broader uptrend.

Initial resistance is aligned with the descending trend line and nearby moving averages around 1.3530/1.3560, and a daily close above this band would open the way toward 1.3630 and the 1.3680 zone, where previous highs stalled. On the downside, immediate support emerges near 1.3450, followed by the recent lows around 1.3400, with a break there exposing the rising trend-line area toward 1.3360. A sustained move below that structural floor would negate the broader bullish structure and signal scope for a deeper pullback toward 1.3300.

(The technical analysis of this story was written with the help of an AI tool.)

Pound Sterling Price This Month

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.27% | 2.48% | 1.90% | 1.03% | -1.00% | 1.32% | 0.40% | |

| EUR | -1.27% | 1.20% | 0.65% | -0.24% | -2.24% | 0.05% | -0.86% | |

| GBP | -2.48% | -1.20% | -0.59% | -1.42% | -3.39% | -1.13% | -2.03% | |

| JPY | -1.90% | -0.65% | 0.59% | -0.85% | -2.85% | -0.58% | -1.48% | |

| CAD | -1.03% | 0.24% | 1.42% | 0.85% | -2.01% | 0.28% | -0.62% | |

| AUD | 1.00% | 2.24% | 3.39% | 2.85% | 2.01% | 2.34% | 1.42% | |

| NZD | -1.32% | -0.05% | 1.13% | 0.58% | -0.28% | -2.34% | -0.91% | |

| CHF | -0.40% | 0.86% | 2.03% | 1.48% | 0.62% | -1.42% | 0.91% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- AUD/USD trades little changed on Friday as the US Dollar retreats despite strong PPI data.

- RBA rate hike bets continue to underpin the Australian Dollar.

- Markets await Australia’s TD-MI Inflation Gauge and the US Manufacturing PMI on Monday.

The Australian Dollar (AUD) trades flat against the US Dollar (USD) on Friday as the Greenback reverses earlier gains despite stronger-than-expected US Producer Price Index (PPI) data. At the time of writing, AUD/USD is trading around 0.7112 and is on track for an eighth consecutive week of gains.

The headline PPI rose 0.5% MoM, beating the 0.3% forecast, while December’s figure was revised down to 0.4% from 0.5%. On a yearly basis, PPI increased 2.9%, above expectations of 2.6%, though slightly below the previous 3% reading.

Core PPI, which excludes food and energy, climbed 0.8% MoM, well above the 0.3% estimate and accelerating from December’s revised 0.6% gain. On an annual basis, core producer inflation advanced to 3.6% from 3.3%.

The data reinforces what Federal Reserve (Fed) officials have been signaling in recent weeks, that inflation pressures remain sticky and progress toward the 2% target is uneven. The stronger core reading in particular supports the case for keeping monetary policy restrictive for longer, even as markets continue to debate the timing of the interest rate cuts.

According to the CME FedWatch Tool, markets widely expect the Fed to keep interest rates unchanged at the March and April meetings. The probability of a June rate cut has declined, with July now seen as the preferred timing for the Fed to resume easing later this year.

The shift in rate-cut expectations could help limit deeper losses in the US Dollar. However, a meaningful recovery may remain unlikely as renewed uncertainty surrounding US trade policy continues to weigh on overall market sentiment.

Apart from broad US Dollar weakness, the Aussie remains well supported by hawkish Reserve Bank of Australia expectations, as inflation remains above the RBA’s 2-3% target range.

While the Board may pause in March to assess the impact of February’s hike, markets and major banks, including CBA, Westpac, ANZ and NAB, expect another 25-basis-point increase at the May meeting, which would lift the cash rate to 4.10%.

Attention now turns to Australia’s TD-MI Inflation Gauge due on Monday. In the United States, traders will also look ahead to the Manufacturing Purchasing Managers’ Index (PMI) release.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

UOB’s Ho Woei Chen expects China’s National People’s Congress to set a 2026 real GDP growth target of 4.5–5.0%, with actual growth forecast at 4.7%. The report highlights a likely 2% CPI target, a fiscal deficit near 4% of GDP, more special local government and ultra-long-term treasury bonds, and modest monetary easing via a 10-bps rate cut and 50-bps RRR reduction.

NPC to balance growth and stability

"We expect the NPC to set a more moderate real GDP target of 4.5–5.0% for 2026, reflecting lower provincial goals, vs. ~5% targets in the past three years. Of the 31 regions, 21 lowered their growth targets compared with 2025. Guangdong – China’s largest province and premier manufacturing hub – has set a growth of 4.5-5.0% compared to ~5% in 2025. We forecast China’s real GDP growth to slow to 4.7% in 2026 from 5.0% in the last two years. Despite our expectation for slower real GDP growth, nominal growth may pick up as deflation eases."

"Last year, China set the CPI target below 3% for the first time since 2004. We expect the CPI target to remain at around 2% for 2026. The actual inflation outturn has been consistently below the official target in recent years with the deviation more pronounced in the last three years. We expect the CPI inflation to rebound to 0.9% in 2026 from 0% in 2025 and the PPI to turn around to +0.2% after declining in the past three years (2025: -2.6%)."

"Continue implementing “a more proactive fiscal policy” and “a moderately loose monetary policy”. Fiscal deficit target is likely to be maintained at around 4% of GDP in 2026 while the quota of special local government bonds may be raised further from its record high of CNY4.4 tn in 2025 to boost support to the local infrastructure building. In addition, China may increase the issuance of its ultra-long-term special treasury bonds this year – we expect around CNY1.5 tn from CNY1.3 tn in 2025."

"For the monetary policy, our base case assumption remains for a 10-bps policy rate reduction, and a 50-bps reserve requirement ratio (RRR) cut this year, similar to 2025. This is likely to be frontloaded in 1H26."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

DBS Group Research expects Indonesia’s February inflation to rise to 4.1% year-on-year, driven by a low base and fading one-off stimulus in administered prices. While most components should stay subdued, elevated precious metal prices are seen lifting personal care costs. The trade surplus is forecast above $3 billion, with a recent US court ruling potentially lowering effective tariffs and supporting exports.

Base effects and metals lift CPI

"Inflation in February likely rose to 4.1% y/y, largely reflecting a low base from the same period last year (Feb 2025: -0.1% y/y)."

"The fading impact of one-off stimulus measures implemented in 1Q25 should also become evident in the administered price component, which had contracted sharply by 9% y/y a year earlier."

"While most components are expected to remain subdued, elevated precious metal prices are likely to filter into the personal care segment, leading to a double-digit increase for the fifth consecutive month."

"Trade data, due the same day, are expected to show the surplus remaining above $3bn."

"Recent developments, including a US court ruling, may result in a modest reduction in Indonesia’s effective tariff rate, boding well for export performance going forward."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

MUFG’s Senior Currency Analyst Lloyd Chan highlights that an escalation in US–Iran tensions could trigger an Oil price shock, reviving global inflation and hurting Asia’s net Oil importers. He notes that during the Russia–Ukraine war, KRW, INR, PHP, and THB underperformed, while MYR and CNY fared better. Overall, Asian FX should benefit from further US rate cuts unless Oil risks materialize.

Oil shock threat to Asian currencies

"A breakdown in diplomacy that escalates into a prolonged Middle East conflict would raise the risk of an oil price shock, reigniting global inflation pressures and worsening the terms of trade for Asia’s net oil importers."

"From an Asian FX perspective, history suggests that an oil price shock would likely trigger broad regional weakness, but with notable differentiation."

"During the first two weeks of the Russia–Ukraine war in 2022, currencies such as KRW, INR, PHP, and THB underperformed, reflecting their sensitivity to higher energy import costs and risk-off flows."

"In contrast, MYR outperformed on the back of rising oil prices, while CNY remained relatively resilient."

"As a result, further US rate cuts would help narrow interest rate differentials, which should broadly support Asian FX, absent an adverse oil price shock."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

- NZD/USD moves higher as the Greenback edges lower at the end of the week.

- Markets expect the Fed to keep rates unchanged in the near term despite persistent inflationary pressures.

- New Zealand’s central bank remains confident about growth while viewing inflation as contained.

NZD/USD trades around 0.6000 on Friday at the time of writing, up 0.19% on the day, benefiting from a modest pullback in the US Dollar (USD) amid a wait-and-see mood ahead of fresh signals on the outlook for monetary policy in the United States (US). The pair remains close to a psychological level as investors adjust positions following recent central bank comments and inflation data releases.

The US Dollar is losing ground despite stronger-than-expected producer inflation figures. The Producer Price Index (PPI) rose by 0.5% MoM in January, above expectations, while the core measure, which excludes food and energy, jumped by 0.8%. On a yearly basis, producer inflation came at 2.9%, above the 2% target set by the Federal Reserve (Fed). These data support the view that the US central bank may keep a cautious stance for longer.

According to the CME FedWatch tool, traders largely anticipate no change in interest rates at the March and April meetings. However, expectations for rate cuts later in the year remain in place. Chicago Fed Bank President Austan Goolsbee stated that he would favor several rate reductions if price pressures sustainably return to the 2% target, while emphasizing that he does not want to act prematurely without clear evidence that inflation is moving back toward the goal.

On the New Zealand side, the New Zealand Dollar (NZD) remains resilient. Investors believe that the Reserve Bank of New Zealand (RBNZ) is unlikely to raise rates in the near term, yet the institution has expressed confidence that the economy can continue to grow without generating renewed inflationary pressures. This perception limits downside pressure on the Kiwi and supports the pair against a slightly softer US Dollar.

New Zealand Dollar Price Today

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies today. New Zealand Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | 0.31% | -0.02% | -0.36% | -0.16% | -0.21% | -0.65% | |

| EUR | 0.16% | 0.47% | 0.15% | -0.19% | 0.00% | -0.06% | -0.49% | |

| GBP | -0.31% | -0.47% | -0.34% | -0.66% | -0.47% | -0.53% | -0.96% | |

| JPY | 0.02% | -0.15% | 0.34% | -0.32% | -0.14% | -0.20% | -0.62% | |

| CAD | 0.36% | 0.19% | 0.66% | 0.32% | 0.19% | 0.12% | -0.30% | |

| AUD | 0.16% | -0.00% | 0.47% | 0.14% | -0.19% | -0.06% | -0.49% | |

| NZD | 0.21% | 0.06% | 0.53% | 0.20% | -0.12% | 0.06% | -0.43% | |

| CHF | 0.65% | 0.49% | 0.96% | 0.62% | 0.30% | 0.49% | 0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

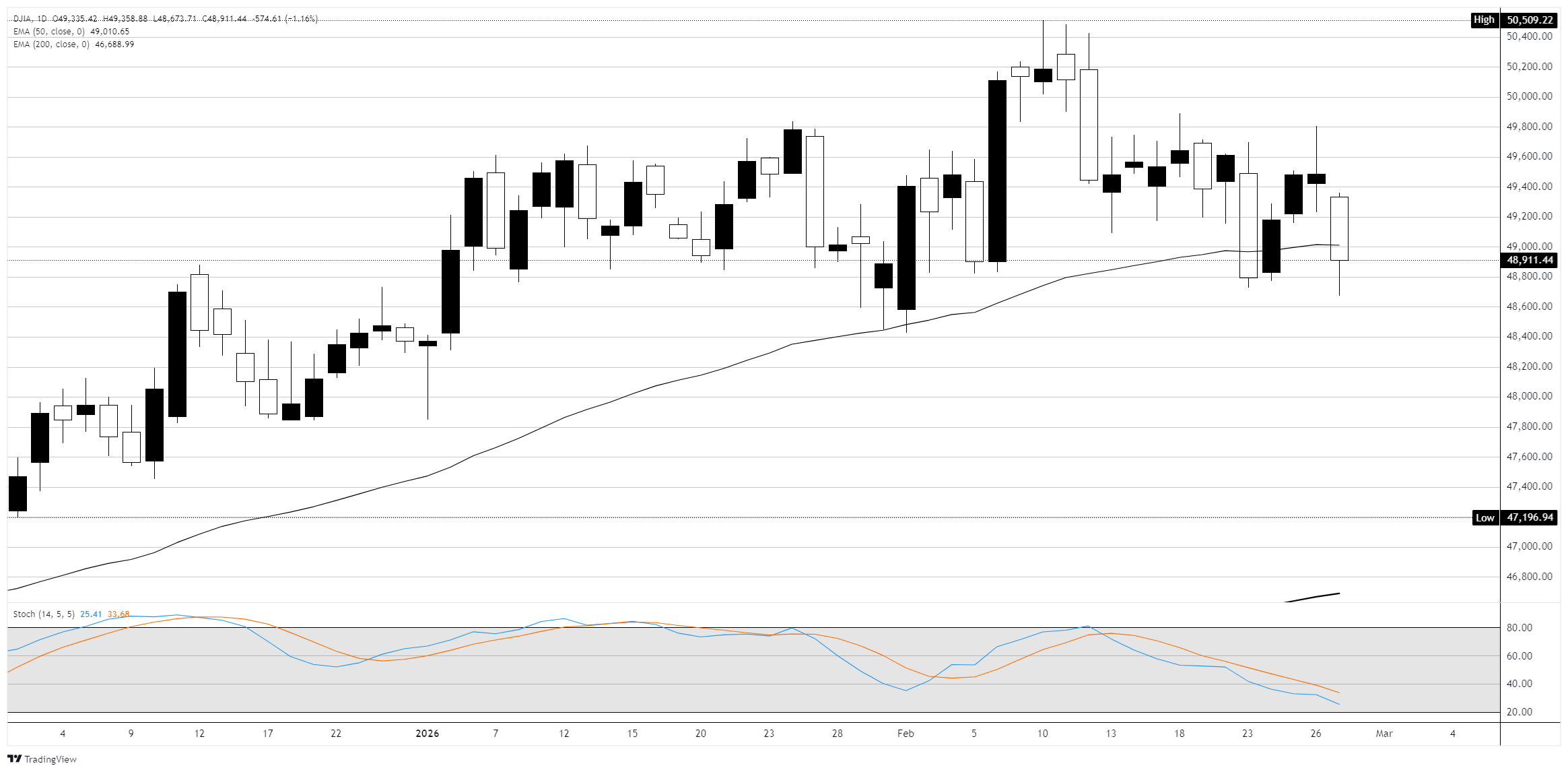

- Major US indexes sold off on Friday, with the Dow falling over 1% and the S&P 500 and Nasdaq both declining.

- PPI inflation came in well above expectations, with core PPI surging 0.8% MoM versus the 0.3% consensus.

- Block surged over 23% after announcing it would cut nearly half its workforce in an AI-driven restructuring.

- Dell jumped 17% on a blowout earnings report and guidance that its AI server revenue will double in fiscal 2027.

The Dow Jones Industrial Average fell 600 points, or 1.15%, tumbling back below 49,000 on Friday, capping off a turbulent final trading week in February. The S&P 500 dropped around 0.7% while the Nasdaq Composite lost roughly 0.9%. All three benchmarks finished February in the red, weighed down by a combination of sticky inflation data, persistent AI disruption fears, and profit-taking in the technology sector following Nvidia's earnings earlier in the week.

Hot wholesale inflation complicates the rate outlook

The Bureau of Labor Statistics (BLS) reported that the Producer Price Index (PPI) rose 0.5% MoM in January, above the 0.3% Dow Jones consensus estimate and up from a revised 0.4% gain in December. More concerning was the core reading, which excludes food and energy: core PPI surged 0.8%, nearly triple the 0.3% forecast and the largest monthly jump since July. On a YoY basis, headline PPI held at 2.9% while core accelerated to 3.6%, both well above the Federal Reserve's (Fed) 2% target. A 2.5% spike in trade services margins drove much of the increase, with evidence of tariff-related pass-through in apparel and chemicals categories. The data matters because several PPI components feed directly into the Personal Consumption Expenditures Price Index (PCE), the Fed's preferred inflation gauge, with economists now estimating core PCE could have risen as much as 0.5% in January. According to the CME FedWatch Tool, markets are pricing in roughly two 25-basis-point rate cuts for 2026, with the next Federal Open Market Committee (FOMC) meeting on March 17-18 widely expected to result in a hold at 3.50%-3.75%.

Block soars on massive AI-driven workforce reduction

Block Inc. (XYZ) surged over 23% after CEO Jack Dorsey announced the fintech company would cut more than 4K employees, slashing its headcount from over 10K to just under 6K. Dorsey framed the move as a bet on artificial intelligence transforming labor productivity, saying he expected the majority of companies to reach the same conclusion within the next year. The cuts came alongside fourth-quarter results that met expectations, with adjusted earnings per share of $0.65 on revenue of $6.25 billion. Gross profit jumped 24% year-over-year to $2.87 billion, driven by a 33% surge in Cash App gross profit. Block raised its full-year 2026 adjusted EPS outlook to $3.66, well above the $3.22 consensus. The stock traded between $51.80 and $69.52 on the session as investors digested the news.

Dell jumps on AI server demand, Nvidia extends losses

Dell Technologies (DELL) rallied 17.5% to around $142 after reporting fourth-quarter revenue of $33.4 billion, handily beating the $31.41 billion consensus, with a 39% year-over-year jump in sales. The standout was AI server demand — Dell closed $64 billion in AI-optimized server orders in Q4 and guided for AI server revenue to roughly double to $50 billion in fiscal 2027. The company also announced a 20% dividend hike and a $10 billion share buyback program. On the other side, Nvidia (NVDA) fell another 2.5% after Thursday's 5.5% plunge, as concerns about the sustainability of AI infrastructure spending continued to overshadow its earnings beat earlier in the week. CoreWeave (CRWV) dropped around 12% after reporting a wider-than-expected loss and EBITDA that missed the $929 million consensus, despite a massive $66.8 billion revenue backlog.

Netflix walks, Paramount wins in Warner Bros. bidding war

Netflix (NFLX) rose about 9% after the streaming giant declined to match Paramount Skydance's (PSKY) revised $31-per-share all-cash bid for Warner Bros. Discovery (WBD). Netflix had previously agreed to an $83 billion deal for a substantial portion of Warner Bros.' assets, but Paramount's updated $108.4 billion offer was deemed a superior proposal by the WBD board. Netflix said the deal was no longer financially attractive at the required price. Analysts viewed the withdrawal as a positive, removing a major overhang and allowing investors to refocus on Netflix's core growth story. Paramount Skydance rose around 4% while Warner Bros. Discovery slipped roughly 2%.

Software sector closes out a brutal February

The broader software sector finished February as one of the worst-performing areas of the market, with the iShares Expanded Tech-Software Sector ETF (IGV) down more than 10% for the month. Oracle (ORCL) lost 17%, Microsoft (MSFT) dropped about 15%, and Salesforce (CRM) tumbled 13% over the same period, as fears about AI disruption to traditional software business models continued to weigh on sentiment. Nvidia CEO Jensen Huang pushed back on the narrative during the week, telling CNBC that markets had overestimated the threat AI poses to software companies, singling out ServiceNow (NOW) as an example. The Dow ended February up roughly 1%, while the Nasdaq Composite fell about 2.5% for the month. Gold held steady near $5,192 per ounce, on track for its seventh consecutive monthly gain, supported by falling real yields and geopolitical uncertainty.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Deutsche Bank outlines a busy UK data calendar, expecting stronger Net Consumer Credit, a partial rebound in Mortgage Approvals to 64.5k, and unchanged PMI Manufacturing and Services at 52.0 and 53.9. The bank anticipates softer DMP price, wage and CPI expectations and another negative employment expectations print.

Credit, PMIs, DMP and fiscal update

"It's a big week ahead. Key for markets will be the Spring Statement. We will also get the final PMIs and DMP survey data. We will also get the BRC Shop Price data and the January credit release."

"We expect net consumer credit to ramp up to GBP 1.7bn. Indeed, retail sales data pointed to a sizeable jump to start the year. And we expect stronger consumer spending to come partly as a result of a jump in credit. On mortgage approvals, we expect the December drop to partly unwind, with data pushing higher to 64.5k. Indeed, new buyer enquiries have picked up since December, according to the RICS survey."

"Perhaps the most important survey data coming out in the week ahead will be the February DMP survey. Here, we will be watching three things. One, firms' output price expectations. We expect this to inch lower to 3.4%. Two, firms' wage growth expectations. Our models point to a small drop off here too - to 3.5%. Three, firms' CPI expectations. We see this also softening. Latest household expectations slowed in February."

"And with CPI slowing, we expect firms to adjust their expectations lower - both in the near-term and medium-term. The last thing to watch will be firms' employment expectations. Another negative print seems likely in the year ahead. We will be watching this closely for any signs of improvement."

"On the PMI releases, we expect no change from the flash print. We see the manufacturing PMI headline staying put at 52. And we expect the services PMI headline index to also stick at 53.9. On construction, we expect the headline data to show a steady improvement to 48.5. Elsewhere, we get the BRC Shop Price Index. After a bigger than expected bump in January, we will be watching closely how retailers continue to price discounts/promotions - particularly around food."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

Forex Market News

Our dedicated focus on forex news and insights empowers you to capitalise on investment opportunities in the dynamic FX market. The forex landscape is ever-evolving, characterised by continuous exchange rate fluctuations shaped by vast influential factors. From economic data releases to geopolitical developments, these events can sway market sentiment and drive substantial movements in currency valuations.

At Rakuten Securities Hong Kong, we prioritise delivering timely and accurate forex news updates sourced from reputable platforms like FXStreet. This ensures you stay informed about crucial market developments, enabling informed decision-making and proactive strategy adjustments. Whether you’re monitoring forex forecasts, analysing trading perspectives, or seeking to capitalise on emerging trends, our comprehensive approach equips you with the insights needed to navigate the FX market effectively.

Stay ahead with our comprehensive forex news coverage, designed to keep you informed and prepared to seize profitable opportunities in the dynamic world of forex trading.