Rollover of FX

What is rollover?

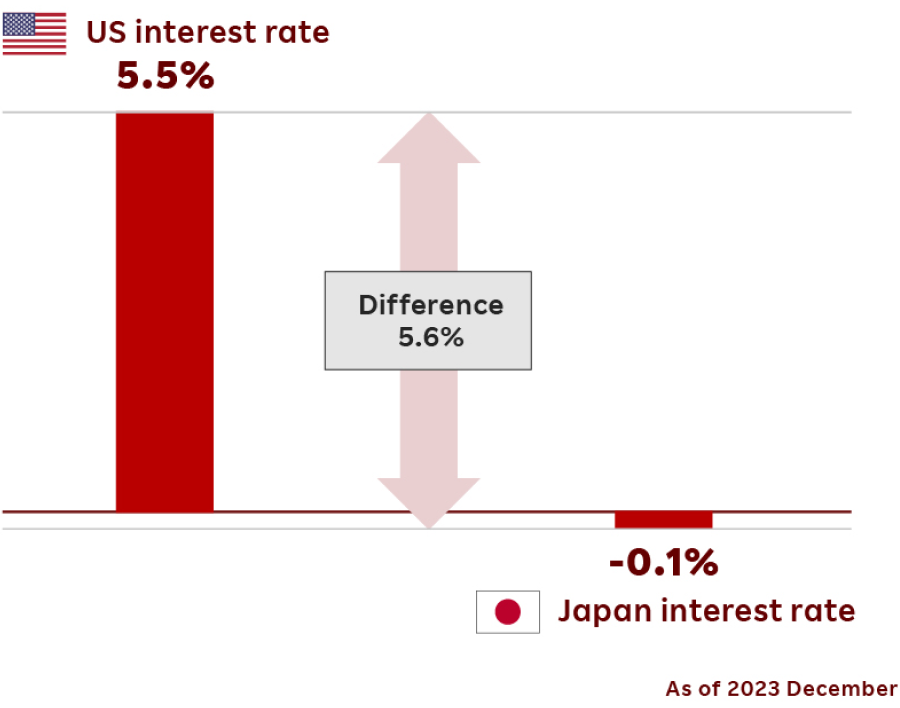

Rollover, also known as swap, is the interest earned or paid for a position kept open overnight, which is caused by a interest rate differential between the currency pair traded.

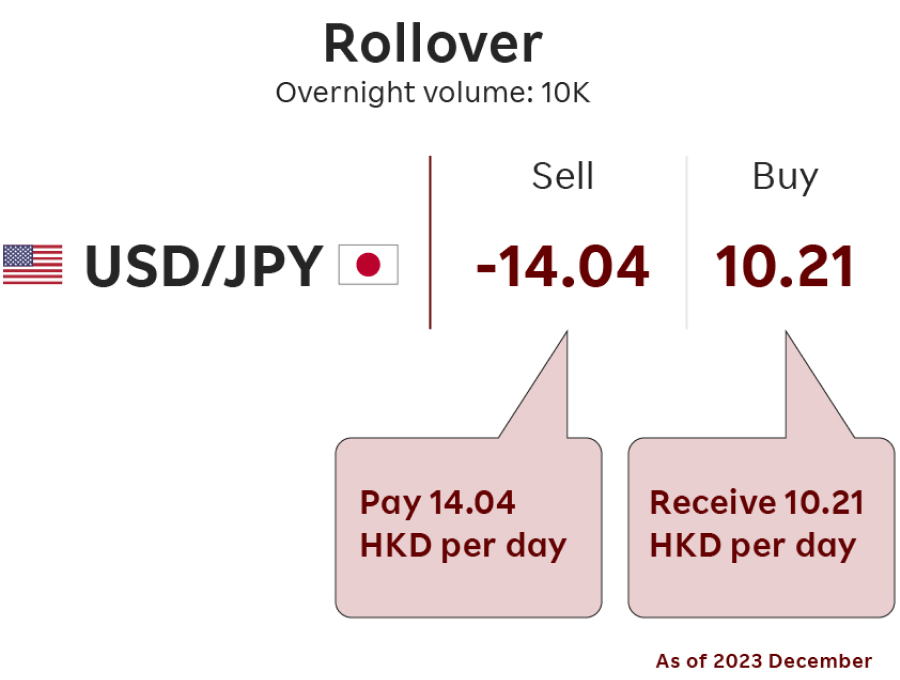

In this example, the interest rate on the US dollar is 5.5% and the interest rate on the Japanese yen is -0.1%. So the rollovers equivalent to the difference of 5.6% will be generated every day. If you buy US dollar and sell yen, you will receive rollovers. However, if you sell US dollar and buy yen, you will pay rollovers.

Carry Trade

Carry trade is one of most popular forex strategy. Traders will aim to generate consistent returns from rollover, by borrowing in a low-interest-rate currency and investing in a high-interest-rate currency.

1

How Carry Trade Works

To receive rollovers, traders can simply hold a buy position of currency pairs, with a higher interest rate currency as the target (buying) currency.

For example, when USD has higher interest than JPY, traders can earn rollover rate by holding a buy position of USD/JPY overnight.

2

Benefits of Carry Trade

1. Steady income

Carry trade can give traders consistent returns if markets stay stable, in addition to the potential profit from the rate difference.This strategy allows traders to aim for profits even when market volatility is low.

Carry trade can give traders consistent returns if markets stay stable, in addition to the potential profit from the rate difference.This strategy allows traders to aim for profits even when market volatility is low.

2. Leverage

When traders open the position using leverage, profit from rollovers can be substantial depending on the amount of leverage used.

When traders open the position using leverage, profit from rollovers can be substantial depending on the amount of leverage used.

*Traders may suffer a loss from the currency rate fluctuations and the resulting losses offset the positive interest payments.

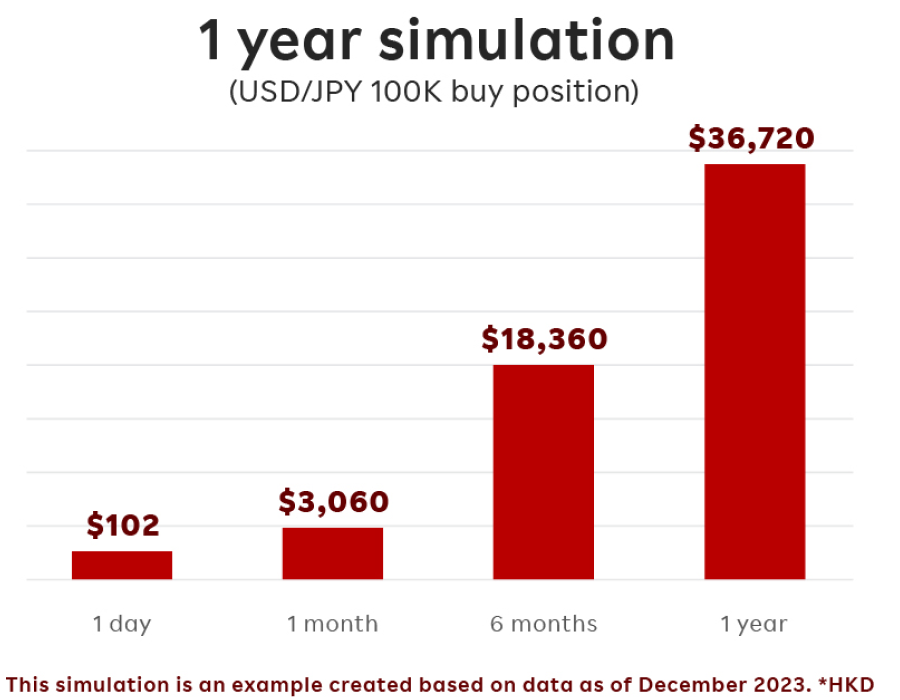

Profit simulation

As rollover is generated daily, yields will continue to increase by holding a high interest rate currency for a long period. If rollover of buying USD/JPY is $10.2 per day, traders can receive more than $36K by holding a buy position of 100K for one year.

With Rakuten Securities HK, traders can enjoy competitive rollover rate for 2 platforms.

How rollover works

- Rollover will be received or paid by holding an open position overnight.

- Rollover credit or debit amount will be reflected in your account balance in the next trading day, within an hour after market open.

- Rollover on Saturdays and Sundays will be reflected at once on Thursdays.

- Please see rollover schedule to check rollover on holidays.

Risk Management

- It is important to avoid high leverage as losses due to exchange rate fluctuations might exceed profit by rollover.

- Rollover fluctuates daily depending on interest rates, it can change from positive to negative.

Exclusive education & support

Market insights

Keep up with the forex market, take advantage of each investment opportunity.

Extensive 1-on-1 support

Get in touch with our Professional Support Team by phone, email or WhatsApp for immediate support.