Forex News

- USD/JPY rises after touching a session high of 158.90.

- Break above 159.00 could trigger intervention fears near the 159–160 zone.

- Drop below 157.97 exposes support at 156.45 and the 50-day SMA at 156.15.

USD/JPY advances for the third straight day, gains 0.07% on Monday as the Greenback remains underpinned due to the Greenback’s safe-haven appeal, and expectations for a less dovish Federal Reserve. The pair trades at 158.02 at the time of writing.

USD/JPY Price Forecast: Technical outlook

The US Dollar remains underpinned despite the high risks of intervention by Japanese authorities.

The USD/JPY rose to a daily high of 158.90, ahead of 159.00 which could’ve risen the alarm amongst Japanese authorities. However, traders booked profits, as the pair retreated toward current exchange rate.

Momentum is tilted to the upside as depicted by the Relative Strength Index (RSI) which is getting close to overbought territory.

With that said, the USD/JPY first resistance is 159.00. A breach of the latter increases the chances of a reversal as the exchange rate would be at intervention zone, seen at around the 159.00-160.00 area.

Conversely, if USD/JPY tumbles below the March 3 high at 157.97 turned support, the next stop would be the March 5 swing low of 156.45. On further weakness, the next stop would be the 50-day Simple Moving Average (SMA) at 156.15 ahead of the confluence of the 20-, 100-day SMAs at 155.49/51.

USD/JPY Price Chart – Daily

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- USD/CAD trims a part of earlier losses as WTI pulls back sharply after surging above $110.

- The BoC is expected to hold steady while markets scale back Fed rate-cut bets.

- Markets look ahead to Canada employment data and US CPI and PCE inflation reports.

The Canadian Dollar (CAD) struggles to build on gains against the US Dollar (USD) on Monday as a sharp pullback in Oil prices weighs on the commodity-linked Loonie, even as the Greenback trades under pressure.

At the time of writing, USD/CAD trades near 1.3584, trimming part of its earlier losses after falling to a daily low around 1.3525.

Canada is a major Oil exporter and is highly sensitive to fluctuations in global Oil prices. Estimates from Scotiabank suggest that a persistent Oil shock could boost Canadian GDP by roughly 0.5% over the next year, based on the estimated impact of a $10 per barrel increase in West Texas Intermediate (WTI) prices.

As the US-Iran conflict widens and continues to disrupt Oil flows through the Strait of Hormuz, WTI opened the week with a bullish gap, briefly climbing to around $113 per barrel before easing sharply from the highs. At the time of writing, WTI is trading near $91.40 per barrel.

The pullback comes after reports that G7 countries are discussing a coordinated release of Oil reserves through the International Energy Agency (IEA) to help ease supply concerns.

Despite the intraday retreat, Oil prices remain elevated. While higher Oil prices tend to support Canada’s growth outlook and the commodity-linked Loonie, they also risk reinforcing inflation pressure globally.

Against this backdrop, the Bank of Canada (BoC) is expected to adopt a wait-and-see approach, maintaining a steady policy stance for now while monitoring the potential inflationary impact of higher energy prices.

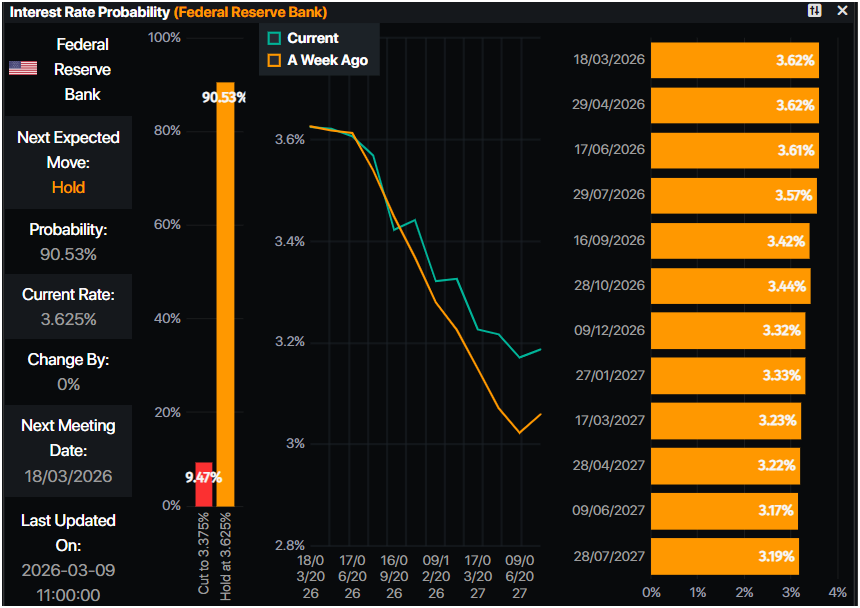

Across the border, markets are increasingly pricing in the Federal Reserve (Fed) to remain on hold for longer and have trimmed expectations for near-term rate cuts. According to the CME FedWatch Tool, the probability of a 25 basis-point rate cut in June stands at 35.3%, down from around 50% a month ago, while the odds of a cut by July stand near 41.2%.

Attention now turns to Canada’s employment data due on Friday, which will provide the final read on labor market conditions ahead of the BoC's March monetary policy decision. In the US, the focus will be on Consumer Price Index (CPI) data on Wednesday and the Personal Consumption Expenditures (PCE) Price Index on Friday.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- XAU/USD falls over 1.5% to $5,090 as DXY climbs toward 99.10.

- WTI surges more than 30% amid shipping disruptions in the Strait of Hormuz.

- G7 may discuss strategic oil reserves release to cap energy price spikes.

Gold (XAU/USD) trims some of its earlier losses on Monday, yet it remains below its opening price by over 1.50% as shipping disruptions in the Strait of Hormuz sent West Texas Intermediate (WTI) Oil prices up more than 30%, to near to $113 a barrel. At the time of writing, XAU/USD trades at $5,090.

Strait of Hormuz disruption drives crude near $120, boosting the Greenback and pressuring bullion

The jump in WTI Oil is driving the US Dollar higher to the detriment of the safe-haven appeal of Bullion. Although it’s seen as an inflation hedge, Oil is dollar-denominated, hence higher petrol prices are underpinning the Greenback, which has reached a nearly three-month high, hitting levels last seen late November 2025.

The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of six peers, is up 0.26 at 99.11, a headwind for Gold.

Hostilities continued with Israel attacking central Iran and Beirut. The Strait of Hormuz remains shut, where a fifth of global Oil is shipped worldwide.

On Sunday, Tehran named Mojtaba Khamenei as the new Supreme Leader Ayatollah, dashing hopes for a quick end to the Middle East conflict.

Recently, the Financial Times revealed that G7 finance ministers plan to discuss petroleum release from their reserves, which could cap higher Oil prices.

Fed expected to cut just once, stocked by expectations of high inflation

Traders seem convinced that the conflict between the US, Israel and Iran might extend further, as depicted by the swaps market, pricing in 36 basis points of rate cuts by the Federal Reserve towards the end of 2026, according to Prime Market Terminal.

Data-wise, the New York Fed Survey of Consumer Expectations (SCE) showed that one-year inflation expectations in February fell to 3% from 3.1% in January, while three- and five-year forecasts remain steady at 3%.

Up next: US inflation data, Core PCE

In the US, the upcoming schedule includes employment figures, housing statistics such as Existing Home Sales, Building Permits, and Housing Starts, along with consumer inflation data and the Federal Reserve's preferred inflation measure, the Core Personal Consumption Expenditures (PCE) Price Index.

XAU/USD technical outlook: Bullish, but momentum is fading

The technical picture shows Gold is upward biased, but failure to clear the $5,200 key resistance area keeps the yellow metal consolidated within the $5,000-$5,194 area. The Relative Strength Index (RSI) shows that buyers are losing momentum, with the index aiming towards its neutral level, failing to clear its latest peak.

If XAU/USD falls below $5,050, the first support would be the $5,000 mark. A breach of the latter will expose the 50-day SMA near $4,868 ahead of the February 17 cycle low at $4,841.

On further strength, if Gold clears $5,100, this opens the door to test $5,150. Once hurdle, the next area of interest would be the March 5 high at $5,194, ahead of the March 4 daily high at $5,206. Up next lies stir resistance like the February 24 high at $5,249 and then $5,300.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

United States (US) President Donald Trump told NBC News on Monday that he did not want to discuss whether he would like the US to seize Iranian Oil, adding that he believes it's too soon to talk about it.

Key takeaways

Trump did not want to discuss whether he would like the US to seize Iranian oil, but added: “Certainly people have talked about it.”

Asked if Congress will approve the bill, the president said: I don’t know.

Nobody is doing much on it, he added. And until they do, I’m not doing anything.

Trump: It is too soon to talk about seizing Iran's oil.”

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.10% | -0.08% | 0.25% | 0.02% | -0.45% | -0.29% | 0.35% | |

| EUR | -0.10% | -0.20% | 0.04% | -0.18% | -0.42% | -0.49% | 0.15% | |

| GBP | 0.08% | 0.20% | 0.25% | 0.02% | -0.22% | -0.29% | 0.35% | |

| JPY | -0.25% | -0.04% | -0.25% | -0.19% | -0.52% | -0.53% | 0.14% | |

| CAD | -0.02% | 0.18% | -0.02% | 0.19% | -0.33% | -0.34% | 0.33% | |

| AUD | 0.45% | 0.42% | 0.22% | 0.52% | 0.33% | -0.06% | 0.57% | |

| NZD | 0.29% | 0.49% | 0.29% | 0.53% | 0.34% | 0.06% | 0.64% | |

| CHF | -0.35% | -0.15% | -0.35% | -0.14% | -0.33% | -0.57% | -0.64% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

MUFG’s Senior Currency Analyst Michael Wan assesses how higher Oil prices and a prolonged Strait of Hormuz closure could affect Bangko Sentral ng Pilipinas policy. Their base case still assumes two more cuts to 3.75% in 2026 as Oil falls to US$70/bbl, but sustained Oil at US$90–100/bbl would push inflation above the BSP’s 4% ceiling in 2026 and likely 2027, raising risks of a policy rethink.

Inflation risks versus growth headwinds

"Will BSP hike rates if the crisis worsens and oil prices spike further? We think the answer is likely “no” right now, but the key distinction is whether this is a temporary supply-side shock perhaps analogous to COVID lockdowns, or proves something more permanent with the potential to raise inflation expectations over time."

"Our current base case forecast is for the BSP to cut rates twice more to 3.75%, likely in June and October, but this is predicated on the crisis resolving by March 2026 and for oil prices to move to US$70/bbl by 2Q2026."

"A scenario of sustained oil prices at US$90/bbl will likely see inflation breach the upper-end of the BSP’s inflation target of 4% in 2026 before coming down to 3.2% in 2027."

"Meanwhile, risk scenarios of sustained oil prices above US$100/bbl will likely see inflation in the Philippines above the 4% upper-end inflation threshold not just for 2026 but also very likely 2027 as well."

"In the latter, we could well see more permanence in inflation rates (and not just price levels) and hence inflation expectations, and warrant a policy rate response, despite being accompanied with far weaker growth prospects."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

ING’s Frantisek Taborsky argues that Central and Eastern European markets remain highly exposed to the US–Iran conflict and rising Oil prices. While local data from Hungary, Turkey and Poland are due, he expects geopolitics to dominate. After Friday’s sharp rates sell-off, he sees renewed pressure on regional FX, especially EUR/HUF, where long HUF positioning is being unwound.

Geopolitics and energy risks hit CEE assets

"On Tuesday, Hungary will release its February inflation, which is expected to fall to this year’s lows of 1.5% YoY, below both market and National Bank of Hungary expectations. Of course, this is old news after the start of the US-Iran conflict, but it will be a starting point for further developments and inflationary pressures coming from higher energy prices."

"On Thursday, the Central bank of Turkey will meet, where the current geopolitical developments and higher-than-expected inflation indicate a halt to the cutting cycle at 37%. On Friday, Poland will release its February inflation, where we expect stagnation at 2.2% YoY."

"However, we will have to put the calendar aside for coming days again. The CEE region remains one of the most exposed markets to the US-Iran conflict globally and after Friday's significant sell-off in rates, no calm can be expected today due to the continued rise in oil prices on the market."

"Friday indicated that in addition to rates, FX is also coming back under pressure in the region and attention is returning to EUR/HUF, which the market sees as the most exposed to energy prices and the impact on inflation. At the same time, long HUF was the largest positioning within CEE3 and is understandably the most under pressure, which will be an indicator of stress in the region today as well."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

- The Japanese Yen remains under pressure despite renewed demand for safe-haven assets.

- Surging Oil prices following strikes on Iranian facilities raise concerns for Japan’s economy.

- Investors now turn their attention to Japan’s revised GDP figures and upcoming US inflation data.

USD/JPY trades around 158.10 on Monday at the time of writing, up 0.10% on the day, as markets react to heightened geopolitical tensions in the Middle East and sharp moves in the energy market.

Oil prices surged after air strikes carried out by the United States (US) and Israel on Iranian depots over the weekend. The West Texas Intermediate (WTI) US Oil price remains about 15% higher at around $101.00, although it has pulled back from an intraday high near $113.00 following reports that G7 members and the International Energy Agency (IEA) may discuss releasing emergency Oil reserves.

Higher Oil prices are generally negative for the Japanese currency. Japan is one of the world’s largest energy importers, meaning that a sustained increase in Oil costs could weigh on the country’s trade balance and economic outlook.

Japan’s Prime Minister Sanae Takaichi said on Monday that households are concerned about rising gasoline prices and that the government is exploring measures to mitigate the impact. However, she added that it is still difficult to assess how the Middle East war could affect Japan’s economy.

On the macroeconomic front, investors are focusing on the revised Gross Domestic Product (GDP) data for Japan’s fourth quarter, scheduled for release on Tuesday. Economists expect the revision to show growth of 0.3%, compared with the preliminary estimate of 0.1%, which could offer support to the Japanese Yen (JPY).

On the US side, the US Dollar (USD) remains firm amid risk-off sentiment and rising energy prices. The US Dollar Index (DXY), which measures the value of the Greenback against a basket of six major currencies, trades around 99.35 after touching a daily high near 99.70.

The conflict involving the United States, Israel and Iran has now entered its tenth day and continues to dominate global market sentiment. Escalating strikes and retaliatory attacks across the region are disrupting Oil flows through the Strait of Hormuz, increasing volatility in foreign exchange markets.

At the same time, expectations for interest rate cuts by the Federal Reserve (Fed) have been scaled back. Policymakers remain concerned about persistent inflation in the United States, and the recent surge in Oil prices reinforces the view that interest rates may need to stay higher for longer.

However, signs of economic weakness are also emerging. Last week’s labor market report showed job losses and a higher Unemployment Rate, raising fears of stagflation and complicating the Fed’s task as it balances inflation risks with a cooling economy.

Markets are now awaiting the release of the US Consumer Price Index (CPI) data for February on Wednesday, which could provide further clues about the direction of US monetary policy and the US Dollar’s trajectory against the Japanese Yen.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.10% | -0.08% | 0.19% | -0.05% | -0.45% | -0.32% | 0.27% | |

| EUR | -0.10% | -0.15% | 0.00% | -0.22% | -0.48% | -0.49% | 0.12% | |

| GBP | 0.08% | 0.15% | 0.15% | -0.07% | -0.33% | -0.35% | 0.27% | |

| JPY | -0.19% | 0.00% | -0.15% | -0.19% | -0.52% | -0.53% | 0.14% | |

| CAD | 0.05% | 0.22% | 0.07% | 0.19% | -0.33% | -0.34% | 0.35% | |

| AUD | 0.45% | 0.48% | 0.33% | 0.52% | 0.33% | -0.01% | 0.61% | |

| NZD | 0.32% | 0.49% | 0.35% | 0.53% | 0.34% | 0.00% | 0.62% | |

| CHF | -0.27% | -0.12% | -0.27% | -0.14% | -0.35% | -0.61% | -0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

- Gold trades under pressure as markets digest shifting macro and geopolitical risks.

- Oil prices surge amid the US-Iran war, raising global inflation concerns, with investors quickly dialing back bets on Fed rate cuts.

- Technically, XAU/USD remains range-bound between $5,000 and $5,200.

Gold (XAU/USD) is consolidating losses on Monday after coming under heavy selling pressure at the start of the week as markets digest shifting macro and geopolitical drivers. At the time of writing, XAU/USD is trading around $5,109, after touching a daily low near $5,014 earlier in the Asian trading session.

The metal lacks follow-through selling as the US Dollar (USD) and Treasury yields ease somewhat from recent highs, with prices still down about 0.95% on the day.

Surging Oil prices deepen inflation concerns amid the US-Iran conflict

The precious metal has remained highly volatile since the US-Iran conflict began. Escalating geopolitical tensions continue to underpin safe-haven demand, helping limit deeper losses. However, at the same time, the war is disrupting Oil flows through the Strait of Hormuz, sending crude prices sharply higher and fuelling global inflation concerns.

West Texas Intermediate (WTI) crude Oil surged to around $113, its highest level since June 2022, before trimming gains after reports that G7 countries are discussing a coordinated release of Oil reserves through the International Energy Agency (IEA) to ease supply concerns. At the time of writing, WTI is trading near $91.40 per barrel, up nearly 3% on the day.

While Gold is often viewed as a hedge against inflation, an Oil-driven inflation shock tends to lift Treasury yields and support the US Dollar, while also reducing expectations for near-term interest rate cuts from major central banks. These factors act as a headwind for the non-yielding metal and continue to cap upside attempts.

Markets have quickly reacted to the surge in energy prices by scaling back expectations for Federal Reserve (Fed) rate cuts. According to the CME FedWatch Tool, the probability of a 25 basis-point (bps) rate cut in June has fallen to around 30%, down from roughly 50% a month ago. Meanwhile, the odds of a July cut stand near 40%.

Soft NFP raises stagflation concerns ahead of US inflation data

Last week’s downside surprise in US Nonfarm Payrolls (NFP) complicates the outlook, highlighting rising stagflation risks and leaving the Fed with a policy dilemma as it tries to balance sticky inflation against deteriorating labour market conditions.

The US economy shed 92K jobs in February, missing expectations for a 59K increase, after adding 126K payrolls in January. The Unemployment Rate rose to 4.4% from 4.3% in the previous month.

Looking ahead, US inflation data due this week could influence interest-rate expectations. Economists expect the Consumer Price Index (CPI) to remain at 2.4% YoY in February, unchanged from January. Meanwhile, the Core Personal Consumption Expenditures (PCE) Price Index (data for January) is expected to hold at 3.0% YoY.

Technical analysis: XAU/USD struggles for direction within $5,000-$5,200 range

From a technical perspective, the near-term bias remains cautiously neutral, with price action fluctuating between $5,000 and $5,200.

XAU/USD is trading marginally below the 100-period Simple Moving Average (SMA) near $5,118, while the 50-period SMA around $5,189 continues to cap upside attempts, indicating fading bullish momentum and a lack of strong directional conviction.

On the downside, a decisive break below the 100-period SMA could open the door for a retest of the $5,000 psychological level. A sustained move below this support may expose deeper downside targets near $4,850, around the February 18 low, followed by $4,650, near the February 6 low.

On the upside, a break above the $5,200 resistance zone could revive bullish momentum and pave the way toward the $5,400-$5,500 region.

Momentum indicators reinforce the consolidative outlook. The Relative Strength Index (RSI) hovers around 43, staying below the neutral 50 level and suggesting modest bearish pressure without entering oversold territory.

Meanwhile, the Moving Average Convergence Divergence (MACD) remains slightly below the zero line with a flattened profile, signaling limited directional conviction in the short term.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- WTI surged past $110.00 in Asian hours on Strait of Hormuz fears before profit-taking pulled the price back toward $93.00.

- The Strait of Hormuz closure is entering its second week, with Iraq, Kuwait, and Saudi Arabia all cutting production as Gulf storage nears capacity.

- US February CPI data due Wednesday could be further complicated by the energy price shock, with January headline inflation running at 2.4% YoY.

West Texas Intermediate (WTI) Crude Oil gained about 5% on Monday, but the headline figure disguised a wild session. Prices gapped open sharply during Asia's early market session, well above Friday's close and surging past $110.00 to print a high above $113.00, testing the highest barrel bids since 2022. Crude Oil markets have pulled all the way back below $95.00, and the resulting daily candle carries a massive upper wick, signaling heavy profit-taking after the overnight spike. Despite the reversal, Crude Oil is still holding above last week's close, which capped the largest weekly gain in WTI futures history at roughly 36%.

The Strait of Hormuz has been effectively shut since March 2, when the Islamic Revolutionary Guard Corps (IRGC) confirmed the closure and warned that any vessel attempting to pass would be targeted. The blockade, triggered by joint US-Israeli strikes on Iran beginning February 28, has halted the transit of roughly 20% of global daily oil supply. Iraq has already cut around 1.5 million barrels per day as onshore storage fills up, Kuwait has reduced output, and Saudi Arabia began its own production cuts on Monday. Goldman Sachs has warned that if the disruption extends beyond 30 days, crude could reach $140.00 to $150.00 per barrel. US President Donald Trump has ruled out negotiating with Iran and said the US Navy will begin escorting tankers through the strait.

On the data front, the Bureau of Labor Statistics (BLS) releases the US February Consumer Price Index (CPI) data on Wednesday. January headline CPI last came in at 2.4% year-over-year, and the sharp run-up in energy costs since late February is likely to filter through into coming prints. Weekly Energy Information Administration (EIA) crude inventory data, also due Wednesday, last showed a build of 3.5 million barrels in the prior report.

WTI daily chart

Technical Analysis

In the daily chart, WTI US OIL trades at $93.15. The near-term bias is bullish as price extends well above both the 50-day and 200-day exponential moving averages, which are rising and aligned in a classic trending configuration. The strong upside acceleration from the mid-$70s into the high $80s and now low $90s confirms firm buying pressure, while the Stochastic oscillator holding in overbought territory reflects persistent momentum rather than an immediate reversal signal. As long as price holds above the shorter EMA cluster, pullbacks are likely to be treated as corrective within the broader advance.

Immediate support emerges near $88.50, where the latest swing area aligns above the rising 50-day EMA around $66.35 and the 200-day EMA near $63.55, forming a wide but robust demand backdrop. A deeper correction would need to break through the mid-$80s and then the $80.00 handle to weaken the current bullish structure on the daily timeframe. On the upside, psychological resistance lies at $95.00, followed by the $98.00 region, where overbought conditions could trigger profit-taking. A sustained break above $95.00 would signal continuation of the uptrend and open the way toward the $100.00 area.

(The technical analysis of this story was written with the help of an AI tool.)

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

National Bank of Canada (NBC) economists Alexandra Ducharme and Jocelyn Paquet expect Canada’s February Labour Force Survey to show a 10K employment gain after January’s decline, but projects the unemployment rate rising to 6.7% as participation ticks up to 65.2%. They also forecast a narrower merchandise trade deficit on stronger Gold‑linked exports and weaker imports, alongside a sharp 3.3% monthly drop in manufacturing sales.

Jobs seen up but jobless rate higher

"In Canada, the main event will be the release of the February Labour Force Survey. After a decline last month, we expect employment to have increased again, with an expected gain of 10K."

"Despite this progression, the unemployment rate may have risen by two-tenths of a point to 6.7%. This is because, after falling by no less than four-tenths of a point in the first month of the year, the participation rate may have risen again, from 65.0% to 65.2%."

"The week will also feature the publication of the January merchandise trade balance. The increase in the price of certain raw materials during the month, notably gold, should have resulted in a further increase in exports."

"Combined with a decline in imports, this could lead to a reduction in the trade deficit to C$0.25 billion. In other news, manufacturing sales may have contracted 3.3% m/m in January, on sharp decreases in the transportation equipment and machinery subsectors."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

Forex Market News

Our dedicated focus on forex news and insights empowers you to capitalise on investment opportunities in the dynamic FX market. The forex landscape is ever-evolving, characterised by continuous exchange rate fluctuations shaped by vast influential factors. From economic data releases to geopolitical developments, these events can sway market sentiment and drive substantial movements in currency valuations.

At Rakuten Securities Hong Kong, we prioritise delivering timely and accurate forex news updates sourced from reputable platforms like FXStreet. This ensures you stay informed about crucial market developments, enabling informed decision-making and proactive strategy adjustments. Whether you’re monitoring forex forecasts, analysing trading perspectives, or seeking to capitalise on emerging trends, our comprehensive approach equips you with the insights needed to navigate the FX market effectively.

Stay ahead with our comprehensive forex news coverage, designed to keep you informed and prepared to seize profitable opportunities in the dynamic world of forex trading.