Forex News

Danske Research Team expects China to maintain its two-speed pattern, with weak domestic demand and strong exports and technology. They project Gross Domestic Product growth of 5% in 2025, easing to 4.8% in 2026 and 4.7% in 2027. The bank sees overcapacity persisting, even as deflation pressures ease and housing headwinds gradually diminish.

Growth slows as overcapacity persists

"China continues to be a two-speed economy with domestic demand being weak while exports and tech powers ahead."

"After another year of 5% growth in 2025, we look for a slight softening to 4.8% in 2026 and 4.7% in 2027, unchanged from our December forecasts."

"We expect the composition of growth to be broadly unchanged in 2026 with sluggish consumption growth while exports are set to remain strong. The drag from housing should ease as construction levels have already fallen substantially."

"We expect overall supply to again outpace demand leaving overcapacity in place. However, there are signs that deflationary pressures are easing."

"In the new Five-Year Plan, China doubles down on tech and puts more weight on consumer demand. It requires new and more forceful measures to stabilize housing, which we believe will take some time still."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

- The New Zealand Dollar clawed back losses as Chinese data lifted antipodean currencies, but the broader pullback from 0.6090 keeps short pressure in focus.

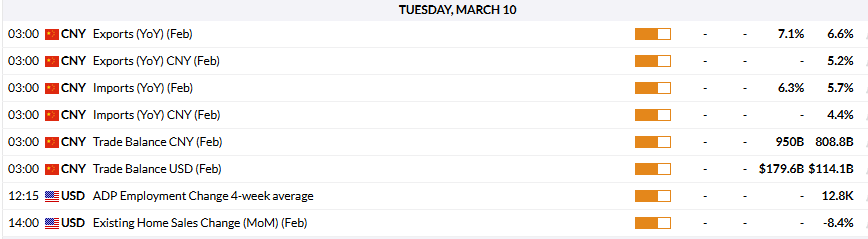

- China's February CPI jumped to 1.3% YoY against a 0.8% forecast; Chinese trade data on Tuesday is the next regional risk event, with exports expected at 7.1% and imports at 6.3%.

- US February CPI due Wednesday; NZ Business PMI for February due Thursday, with the prior reading at 55.2.

NZD/USD rose about 0.6% on Monday, closing near 0.5950 after knocking on 0.5850 in the early session. The pair found support near the 200-day Exponential Moving Average (EMA) before recovering to close above the 50-day EMA, producing a candle with a long lower wick, suggesting buyers are defending the 0.5850 to 0.5900 zone. Since peaking near 0.6090 in early February, the pair has been grinding lower, forming lower highs while holding above the 0.5850 area.

Monday's better-than-expected Chinese Consumer Price Index (CPI) data (1.3% YoY versus 0.8% consensus) provided a lift across antipodean currencies, though the Strait of Hormuz crisis continues to cap risk appetite. Chinese February trade data on Tuesday is the next test of regional demand, with exports forecast at 7.1% YoY and imports at 6.3%.

On the domestic side, New Zealand's February Business NZ Purchasing Managers Index (PMI) is due Thursday after a solid 55.2 reading in January. Wednesday's US February CPI release is the week's dominant event for the US Dollar side of the pair, with headline inflation expected at 0.3% MoM and 2.4% YoY.

NZD/USD daily chart

Technical Analysis

In the daily chart, NZD/USD trades at 0.5936. The near-term bias is mildly bearish as spot continues to retreat from the early-month highs while holding well above the clustered 50-day and 200-day exponential moving averages near 0.59 and 0.58, which preserve a broader upward context. Price action has slipped back into the recent range, and the Stochastic oscillator has turned higher from the low-30s, signalling fading downside momentum rather than a confirmed bullish reversal, which argues for a consolidative to softer tone while below recent peaks.

Initial resistance emerges at 0.6000, where recent swing highs align with the latest rejection area, followed by 0.6050 as the next barrier if buyers regain control. On the downside, immediate support is at 0.5900, protecting a deeper pullback toward 0.5850, where the rising 50-day EMA begins to reinforce the prior breakout area. A sustained break below 0.5850 would expose the 0.5800 zone, closer to the 200-day EMA, and would weaken the medium-term bullish structure.

(The technical analysis of this story was written with the help of an AI tool.)

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The Australian Dollar rallied as hot Chinese inflation data lifted sentiment ahead of Tuesday's China trade figures.

- China's February CPI surged to 1.3% YoY, well above the 0.8% consensus, driven by extended Lunar New Year spending; core CPI hit 1.8%, the strongest pace since March 2019.

- US February CPI due Wednesday at 0.3% MoM and 2.4% YoY; Thursday brings Australian consumer inflation expectations for March.

AUD/USD jumped about 0.8% on Monday, closing just shy of 0.7100 in a session that erased a large portion of last week's pullback. The pair traded as low as 0.6960 before buyers stepped in aggressively, producing a bullish candle with a long lower wick that signaled firm demand below the 0.7000 level. Price has been oscillating in a broad range between 0.7000 and the year-to-date high near 0.7150 since mid-February, and Monday's bounce keeps the pair firmly in the upper half of that range.

China's February Consumer Price Index (CPI) beat expectations on Monday, rising 1.3% YoY against a consensus of 0.8%. The surge was largely seasonal, tied to an extended nine-day Lunar New Year holiday that boosted spending on travel, dining, and services. Producer prices fell 0.9% YoY, better than the expected 1.1% decline, with rising metals and energy costs helping to narrow factory-gate deflation. Chinese trade data on Tuesday is the next regional catalyst, with February exports expected at 7.1% YoY growth and imports forecast at 6.3%.

In Australia, Energy Minister Chris Bowen disclosed that the country holds just 36 days of petrol reserves, well below the 90-day threshold recommended by the International Energy Agency (IEA), keeping the Strait of Hormuz supply shock front of mind for domestic policy. The Reserve Bank of Australia (RBA) meets on March 17, with markets pricing roughly 30% odds of another hike; a move to 4.10% in May is priced in further. Wednesday's US February CPI is the week's marquee data risk for the pair.

AUD/USD daily chart

Technical Analysis

In the daily chart, AUD/USD trades at 0.7077. The pair holds a firm bullish bias as price action remains well above the rising 50-day and 200-day exponential moving averages, underscoring an established uptrend despite recent consolidation under 0.7100. The latest pullback from the recent high has not damaged the broader structure, with the stochastic oscillator easing from overbought territory toward mid-range, indicating fading upside momentum rather than a clear reversal. This combination points to a market that is pausing within an ongoing advance, with dips more likely to attract buying interest while the broader trend structure remains intact.

Initial support aligns near 0.7040, where recent lows converge with short-term congestion, followed by a deeper cushion toward 0.7000 if sellers extend the correction. A break below that area would expose the next bearish objective closer to 0.6950, where buyers previously re-emerged. On the upside, immediate resistance appears at 0.7100, guarding the recent peak around 0.7120, and a clear break above this band would signal renewed trend continuation toward higher highs. As long as spot holds above 0.7040, the near-term technical framework continues to favor an eventual retest and potential breach of the 0.7100–0.7120 ceiling.

(The technical analysis of this story was written with the help of an AI tool.)

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Commerzbank’s Volkmar Baur sees growing evidence that China is exiting deflation, with consumer prices up 1.3% year-on-year in February and producer prices turning higher month-on-month. Rising services and food prices underpin this shift. As inflation improves, Baur expects no major PBoC rate cuts and maintains a forecast for slight CNY appreciation versus the US Dollar this year.

China price data point to deflation end

"There are increasing signs that China could see rising prices again this year."

"This gives hope that consumer prices will also establish themselves in positive territory in the coming months."

"Positive signals are also coming from producer prices, which rose again by 0.4% month-on-month. It appears that producer prices will also return to positive territory year-on-year in the coming months."

"The positive development in inflation makes it less likely that the central bank will adjust its interest rates this year."

"We therefore continue to expect a slight appreciation of the CNY against the US dollar this year."

(This article was created with the help of an Artificial Intelligence tool and reviewed by an editor.)

United States (US) President Donald Trump told NBC News on Monday that he did not want to discuss whether he would like the US to seize Iranian Oil, adding that he believes it's too soon to talk about it.

Key takeaways

Trump did not want to discuss whether he would like the US to seize Iranian oil, but added: “Certainly people have talked about it.”

Asked if Congress will approve the bill, the president said: I don’t know.

Regarding a bill that would tighten voting requirements, Trump noted “Nobody is doing much on it," he added. "And until they do, I’m not doing anything.”

Trump: It is too soon to talk about seizing Iran's oil.”

US President Trump spoke to other media and stated that the Iran war could be over soon "I think the war is very complete, pretty much. They have no navy, no communications, they’ve got no Air Force," Trump told CBS in a phone interview.

On Iran's new Supreme leader Mojtaba Khamenei, Trump told CBS News: "I have no message for him."

Finally, Trump said to Al Arabiya that controlling Iran's oil could strain US relations with China."

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.10% | -0.08% | 0.25% | 0.02% | -0.45% | -0.29% | 0.35% | |

| EUR | -0.10% | -0.20% | 0.04% | -0.18% | -0.42% | -0.49% | 0.15% | |

| GBP | 0.08% | 0.20% | 0.25% | 0.02% | -0.22% | -0.29% | 0.35% | |

| JPY | -0.25% | -0.04% | -0.25% | -0.19% | -0.52% | -0.53% | 0.14% | |

| CAD | -0.02% | 0.18% | -0.02% | 0.19% | -0.33% | -0.34% | 0.33% | |

| AUD | 0.45% | 0.42% | 0.22% | 0.52% | 0.33% | -0.06% | 0.57% | |

| NZD | 0.29% | 0.49% | 0.29% | 0.53% | 0.34% | 0.06% | 0.64% | |

| CHF | -0.35% | -0.15% | -0.35% | -0.14% | -0.33% | -0.57% | -0.64% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

- Silver jumps to $86.35 after rebounding from $79.65 session low.

- A break above $90.00 would target $96.39 and the $100 milestone.

- Support lies at the 50-day SMA at $85.51, then $79.66.

Silver (XAG/USD) price climbs over 2% on Monday as the Greenback pares some of its previous gains, a tailwind for the precious metals segment. At the time of writing, XAG/USD trades at $86.35 after bouncing off daily lows of $79.65.

XAG/USD Price Forecast: Technical outlook

Silver’s technical picture shows that XAG/USD is consolidating within the $80.00-$96.50 range, with neither buyers nor sellers unable to crack the top/bottom of that area. Momentum is in favor of the bulls, as depicted by the Relative Strength Index (RSI), but it remains fragile.

On the upside, the key resistance is the $90.00 figure. Once cleared, the next stop would be the March 2 swing high at $96.39, followed by the $97.00 mark. Up next, the following area of interest would be the $100.00 milestone, followed by the January 30 high at 118.47.

On the flip side, Silver’s first support would be the 50-day Simple Moving Average (SMA) at $85.51. On further weakness, the next stop would be the March 9 swing low at $79.66 ahead of the March 3 cycle low of $77.98.

XAG/USD Price Chart – Technical outlook

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Here is what you need to know on Tuesday, March 10:

News that several countries have cut Oil output hit the financial markets on Monday as Oil producers claimed they are unable to export through the Strait of Hormuz amid threats from Iran. West Texas Intermediate (WTI) hit a three-year high near $113 during the Asian session but corrected lower after reports that the G7 was planning to release emergency crude reserves to stabilize markets, extending losses after the Wall Street open as US stocks shrugged off concerns and turned positive.

The US Dollar Index (DXY) is trading near the 98.90 price zone, retreating from its intraday gains at the start of the week as riskier assets attract more attention.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.29% | -0.11% | -0.13% | -0.72% | -0.55% | 0.15% | |

| EUR | 0.08% | -0.21% | 0.06% | -0.05% | -0.63% | -0.53% | 0.23% | |

| GBP | 0.29% | 0.21% | 0.28% | 0.16% | -0.42% | -0.26% | 0.44% | |

| JPY | 0.11% | -0.06% | -0.28% | -0.12% | -0.72% | -0.54% | 0.15% | |

| CAD | 0.13% | 0.05% | -0.16% | 0.12% | -0.60% | -0.43% | 0.27% | |

| AUD | 0.72% | 0.63% | 0.42% | 0.72% | 0.60% | 0.16% | 0.88% | |

| NZD | 0.55% | 0.53% | 0.26% | 0.54% | 0.43% | -0.16% | 0.71% | |

| CHF | -0.15% | -0.23% | -0.44% | -0.15% | -0.27% | -0.88% | -0.71% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

EUR/USD is trading near the 1.1580 price region, trimming its intraday losses and rising by over 0.15%, as low demand for riskier assets amid the intensified war in the Middle East has faded during the American session.

GBP/USD is trading near the 1.3390 price zone, trading in a tight bound range, still in the green as the US Dollar (USD) loses traction against all major currencies.

USD/JPY is trading near 158.30, with limited losses as the Greenback recedes some of its ground on a firmer Japanese Yen (JPY). Japan’s Prime Minister Sanae Takaichi said on Monday that households are concerned about rising gasoline prices and that the government is exploring measures to mitigate the impact.

AUD/USD is surging near the 0.7050 level, as stronger-than-expected economic data from China provides support to the Chinese-linked Australian Dollar (AUD).

West Texas Intermediate (WTI) Oil is trading near $94.90 per barrel, after the black gold hit a three-year high above $113 in the Asian session. The G7 members and the International Energy Agency (IEA) are working to release emergency oil reserves to ease concerns about supply disruptions. Oil prices could push global inflation higher, raising stagflation risks.

Gold is trading at $5,120, posting a slight decline after trimming back almost all its Asian-session losses, but still failing to regain traction.

What’s next in the docket:

Tuesday, March 10:

- UK February BRC Like-For-Like Retail Sales.

- China February Exports.

- China February Trade Balance.

- Germany January Trade Balance.

- Eurozone, EcoFin Meeting.

- United States ADP Employment Change 4-week average.

- United States February Existing Home Sales Change.

Wednesday, March 11:

- Germany February HICP.

- UK BoE Monetary Policy Report Hearings.

- UK Consumer Inflation Expectations.

- United States February CPI.

Thursday, March 12:

- Australia March Consumer Inflation Expectations

- UK January Industrial Production.

- United States January Building Permits.

- United States January Housing Starts.

- United States Initial Jobless Claims.

- United States February Monthly Budget Statement.

- New Zealand February Business NZ PMI.

Friday, March 13:

- UK January GDP.

- UK January Manufacturing Production.

- Spain February HICP.

- Eurozone January Industrial Production s.a.

- Canada February Average Hourly Wages.

- Canada February Net Change in Employment.

- Canada, February, Unemployment Rate.

- United States January Core Personal Consumption Expenditures - Price Index.

- United States Flash (Q4) Core Personal Consumption Expenditures.

- United States January Durable Goods Orders.

- United States Flash (Q4),Gross Domestic Product Annualized.

- United States Flash (Q4) Gross Domestic Product Price Index.

- United States January Nondefense Capital Goods Orders ex Aircraft.

- United States January Personal Consumption Expenditures - Price Index.

- United States Flash (Q4) Personal Consumption Expenditures Prices.

- United States January Personal Income.

- United States January Personal Spending.

- United States Flash March Michigan Consumer Expectations Index.

- United States Flash March Michigan Consumer Sentiment Index.

- United States Flash March UoM 1-year Consumer Inflation Expectations.

- United States January JOLTS Job Openings.

- United States Flash March UoM 5-year Consumer Inflation Expectation.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The US Dollar Index printed a bearish reversal candle as markets brace for Wednesday's CPI.

- February CPI due Wednesday with headline consensus at 0.3% MoM and 2.4% YoY; core CPI expected at 0.2% MoM and 2.5% YoY.

- Friday brings January core PCE at 0.4% MoM and 3% YoY, preliminary Q4 GDP at 1.4%, and March Michigan consumer sentiment forecast at 55.

The US Dollar Index (DXY) slipped about 0.20% on Monday after touching a 15-week high near 99.70 in the early session. The index gapped higher at the open before sellers stepped in, pushing price back toward the 99.00 area by the close and leaving a long upper wick on the daily candle. The reversal came after a sharp rally from the late-January lows close to 95.56, with the index gaining roughly four points in six weeks as safe-haven demand and shifting rate expectations lifted the Greenback.

The US Dollar (USD) has been the primary beneficiary of the Strait of Hormuz crisis, with traders viewing the US as relatively insulated from the supply shock given its energy independence. Rate cut expectations have been scaled back sharply over the past week; markets now price only one 25 basis-point cut from the Federal Reserve (Fed) this year, likely in September, compared with two cuts expected before the conflict began. The Fed is holding rates at 3.50% to 3.75%, and January Federal Open Market Committee (FOMC) minutes showed several officials discussed the possibility of hiking rates if inflation stays above target.

Wednesday's February Consumer Price Index (CPI) release from the Bureau of Labor Statistics (BLS) is the week's marquee event, with headline CPI expected at 0.3% MoM and 2.4% YoY. The energy price shock from the Hormuz closure began in the final days of February and is unlikely to be fully captured in this print, though any upside surprise would further cement the hawkish repricing. Friday's slate is equally dense: January core Personal Consumption Expenditures Price Index (PCE) is forecast at 0.4% MoM and 3% YoY; preliminary fourth-quarter Gross Domestic Product (GDP) is expected at 1.4% annualized; and the University of Michigan (UoM) March consumer sentiment index is forecast to drop to 55 from 56.6.

DXY daily chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Forex Market News

Our dedicated focus on forex news and insights empowers you to capitalise on investment opportunities in the dynamic FX market. The forex landscape is ever-evolving, characterised by continuous exchange rate fluctuations shaped by vast influential factors. From economic data releases to geopolitical developments, these events can sway market sentiment and drive substantial movements in currency valuations.

At Rakuten Securities Hong Kong, we prioritise delivering timely and accurate forex news updates sourced from reputable platforms like FXStreet. This ensures you stay informed about crucial market developments, enabling informed decision-making and proactive strategy adjustments. Whether you’re monitoring forex forecasts, analysing trading perspectives, or seeking to capitalise on emerging trends, our comprehensive approach equips you with the insights needed to navigate the FX market effectively.

Stay ahead with our comprehensive forex news coverage, designed to keep you informed and prepared to seize profitable opportunities in the dynamic world of forex trading.