Key Factors and Events of Forex Market 2023

Factors that influence foreign exchange rates

The factors of the fluctuation in exchange rate can be classified into political factors and economic factors.

Political factors include events such as elections and international conferences. As for economic factors, it is worth paying attention to the central bank’s monetary policy, which greatly influences the exchange rate in medium and long term, and Gross Domestic Product (GDP), Consumer Price Index (CPI), and economic indicators such as the US employment statistics are important in determining the monetary policy.

The focus of this year will be the consumer price and the Fed’s interest rate hike pace same as last year. Furthermore, policy revisions by the Bank of Japan and trends in the global economy are expected to be the main factors in determining exchange rates.

6 important factors in 2023

1. US consumer price

2. Fed interest rate hike

3. Bank of Japan’s policy revision

4. Japan’s trade deficit

5. China’s economic recovery

6. Geopolitical risk

1. US consumer price

To judge if the housing price will fall in the US, the most important reference factor is to see whether rents will decline around spring. As for the commodity price, if the slowdown in the service industry continues, we may have hopes for a decline in prices.

2. Fed interest rate hike

The Fed will decide whether to raise interest rates while keeping an eye on price trends, but it is expected that expectations for a halt to interest rate hikes will rise after early July.

However, it may be difficult to cut interest rates this year. If the economy deteriorates, market expectations focus will be shifted from inflationary measures to economic measures. Even if prices of commodities fall due to the economic slowdown, if they remain high interest rate above 2% above the inflation target, a rate cut will be a source of turmoil for the market.

3. Bank of Japan’s policy revision

Monetary easing policy revisions will be expected at each monetary policy meeting of the Bank of Japan this year.

With Governor Kuroda’s term expires around April 8, it is expected that the view of policy revisions will prevail.. Japan’s lower house approved Ueda as next BOJ chief, however, it should be noted that if there is no change on the policy, the yen will continue to depreciate.

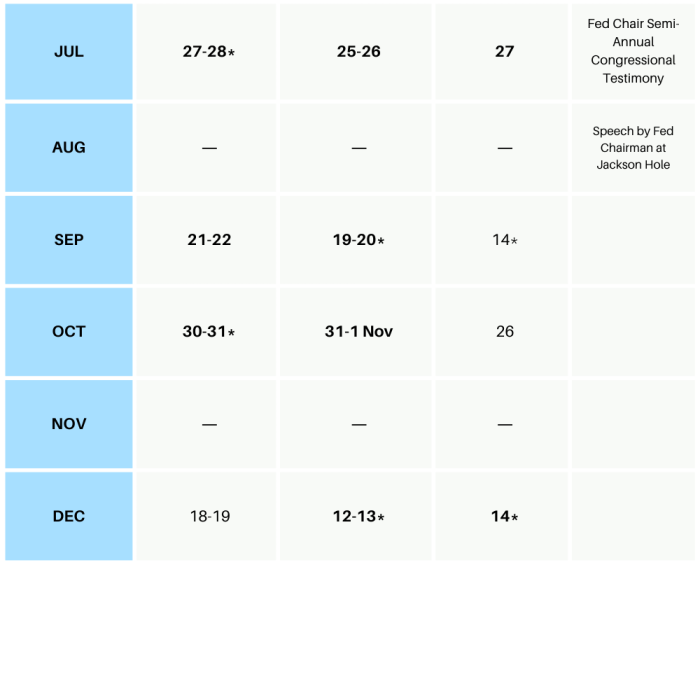

The new Governor of the Bank of Japan will attend the Monetary Policy Meeting for the first time on April 27-28, also FOMC (Federal Open Market Committee) (May 2-3) is just four days away.

4. Japan’s trade deficit

The deficit in the balance of trade, which is calculated by subtracting imports from Japan’s exports, is a factor behind the yen’s depreciation. It may not be able to hope for a rapid reduction in the deficit, but even a gradual decline is expected to a stronger yen.

However, it is possible that exports will not perform well due to the global recession and the trade deficit will not decrease as much as expected.

5. China’s economic recovery

China’s economic recovery was expected with the end of the “Zero Corona Policy,”. However, the rapid increase in the number of infected people has raised the possibility that economic recovery in the first half of the year will not be possible.

The global economy is expected to remain sluggish. According to the World Economic Outlook released by the Organization for Economic Co-operation and Development (OECD) in November last year, the GDP growth of global economy in 2023 is 2.2%, while 0.5% for the US, 0.5% for Eurozone, 1.8% for Japan and 4.6% for China. US GDP could outperform on recent strong economic data.

However, if China’s economy continues to contract due to the spread of the new coronavirus, it may be quite difficult to achieve 4.6%. With US and European growth forecasts as low as 0.5%, further deterioration in China’s economy could quickly turn negative.

Among Japan, the United States, and Europe, Japan’s growth rate forecast is the highest and seems promising, but if the Chinese economy deteriorates more than expected and the United States and Europe experience negative growth, it will have a major negative impact on Japan as well.

6. Geopolitical risk

It is necessary to be cautious of trends in Russia and China. Eurasia Group, a US political risk research company, has ranked Russia and China’s moves first and second in this year’s “Top 10 Risks” list. Geopolitical risks are completely unpredictable, as Russia’s invaded Ukraine on February 24 last year.

Important political events in 2023

Important economic events in 2023

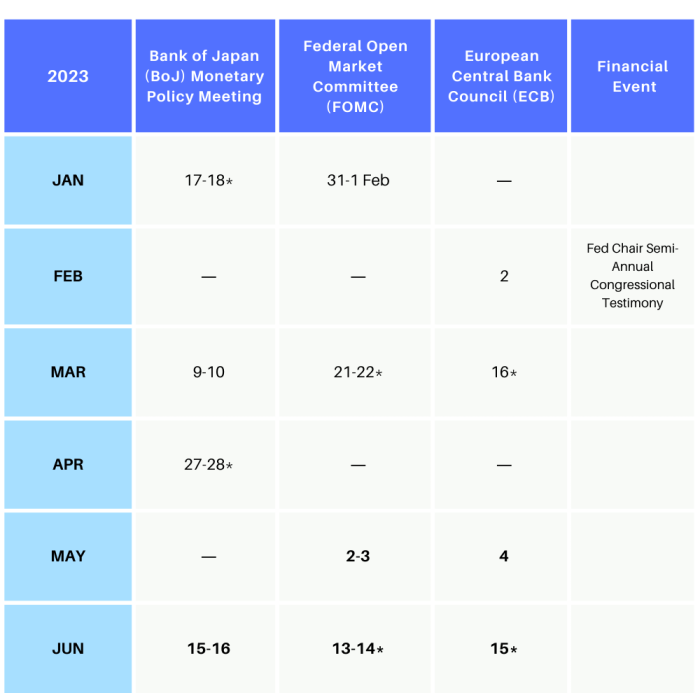

Schedule of Monetary Policy Meetings

Note

Information extracted from: https://media.rakuten-sec.net/articles/-/40211 translated and updated by Rakuten Securities HK

本報告的作用純粹為提供資訊。樂天證券香港有限公司(“樂天證券香港”) 及其員工並不會對提供或轉發其他機構所提供之報告內容之準確性、完整性或正確性作出明示或默示之保證。本報告內之所有意見均可在不作另行通知之下作出更改。本報告不應被解作為提供明示或默示的買入或沽出與外匯有關合約的要約。樂天證券香港在法律上均不負責任何人因使用本報告內資料而蒙受的任何損失(無論是直接或間接的損失)。本報告在未獲樂天證券香港許可前,不得翻印、分發或發行本報告以作任何用途。