Free Seminars

Upgrade your trading skills by joining our seminars.

Find a wide range of topics that suits your trading style and experience level, and get your questions answered by our experts for free.

Find a wide range of topics that suits your trading style and experience level, and get your questions answered by our experts for free.

Up-coming Seminars

- Choose the seminars that you want to join

- Input your information in the form to register

2ba24594fefb224158254ad0fbac998eff798c3164f54c56886f865b032231b8

1.Choose Forex Seminars

More seminars / webinars are coming! Stay tuned!

2.Register Now

Input your information in the form to register.

Ready to Get Started?

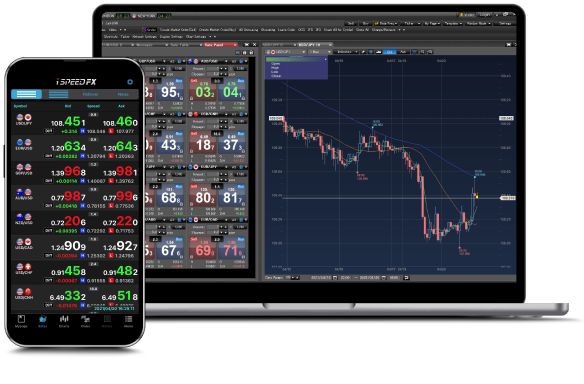

Download trading platform

Rakuten FX