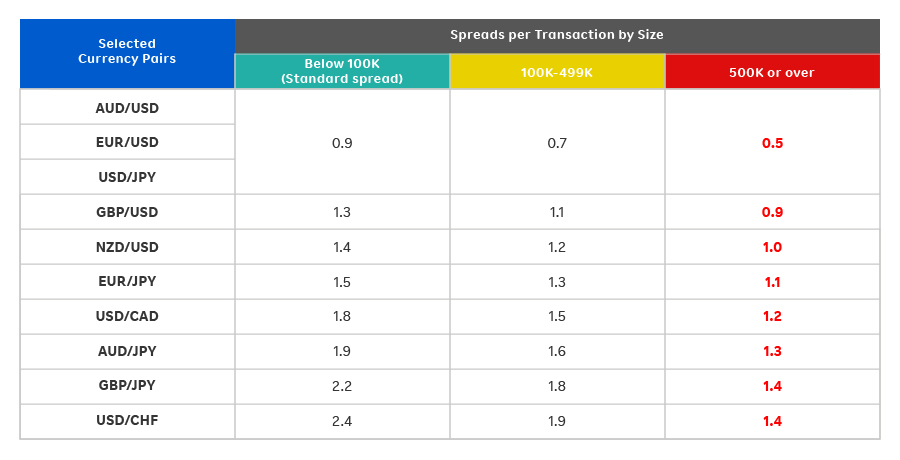

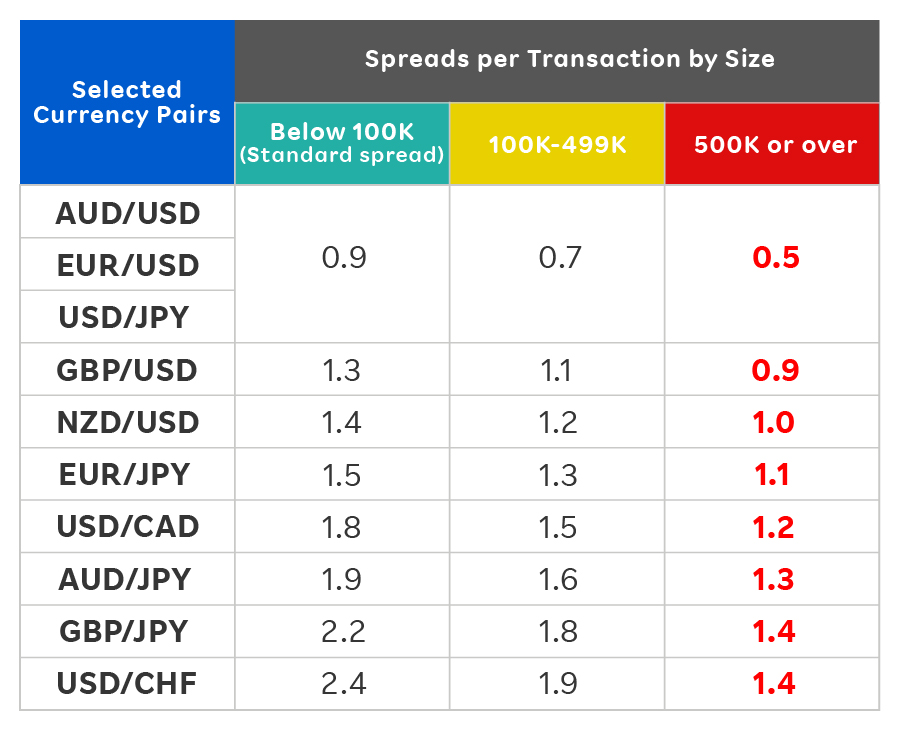

Volume-based Ladder Spreads

A Brand-new Spread Charging Concept!

Being the pioneer in the market! Fixed spreads¤ as low as 0.5 pips depending on your transaction size! No commission!

Probably the lowest spread in the market!

Higher trading volume, lower trading cost!

Rakuten FX provides lower spreads on different contract sizes for the 10 selected currency pairs! Place a large position now!

The special offer for above currency pairs will be valid from 31 Oct (6:00a.m) until further notice.

How can you benefit from the volume-based ladder spreads?

How can we do this?

-

Excellent financial basis as a subsidiary of Rakuten Securities, Inc., which is the largest broker in Japan#

-

Combination of top tier liquidities and unique risk management system

-

Strong commitment to Hong Kong market as the market leader in leveraged forex

-

Trade with trust!

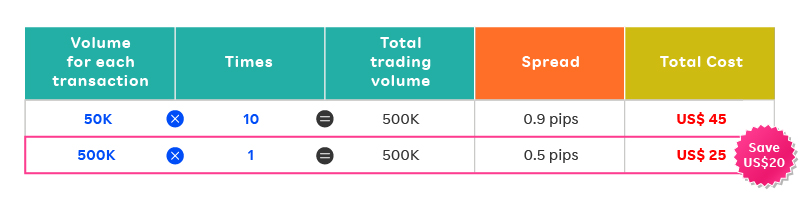

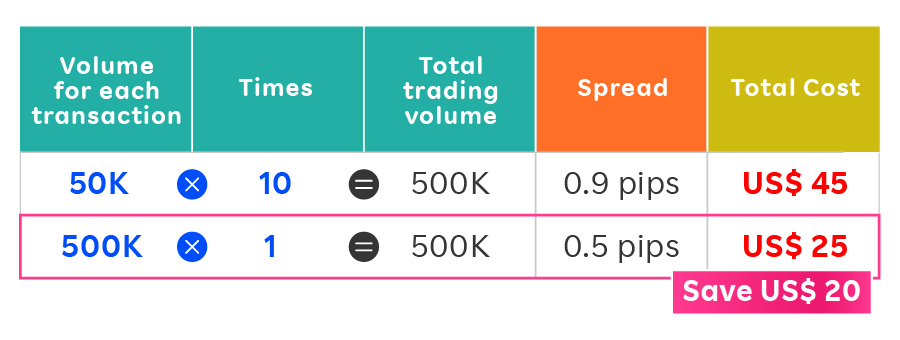

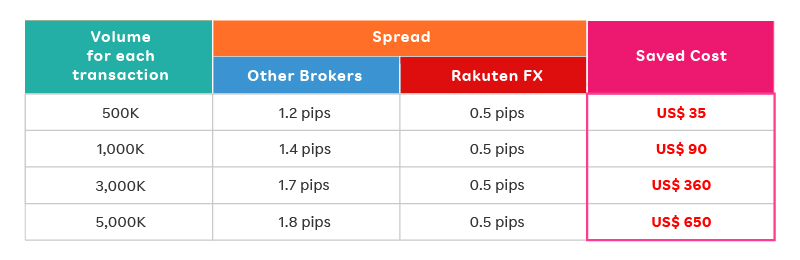

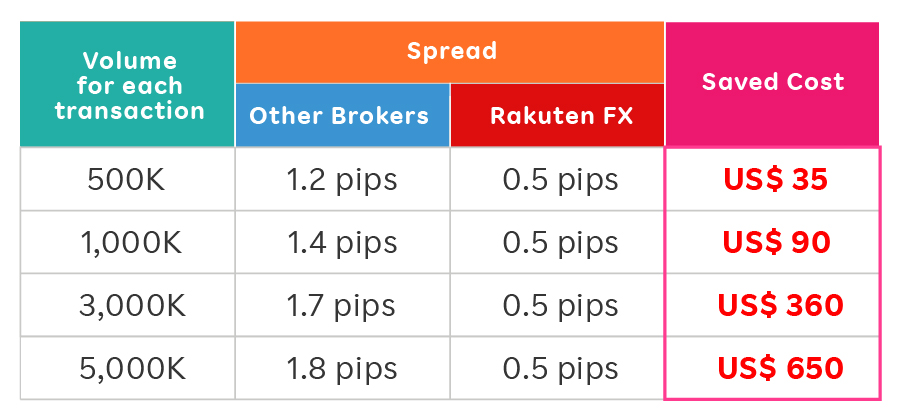

How much can you save?

Taking AUD/USD as an example, you can save US$20 if you trade 500K at once with 0.5 pips, compared to trading a total of 50K in 10 times.

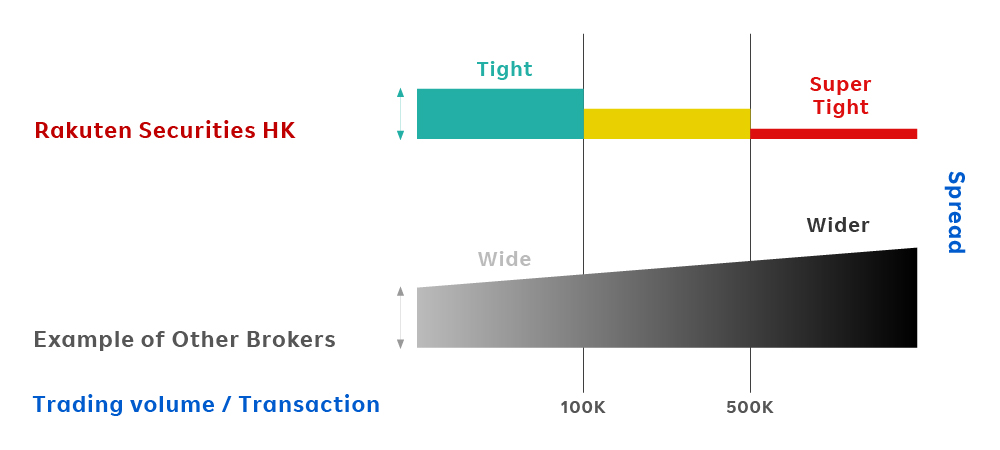

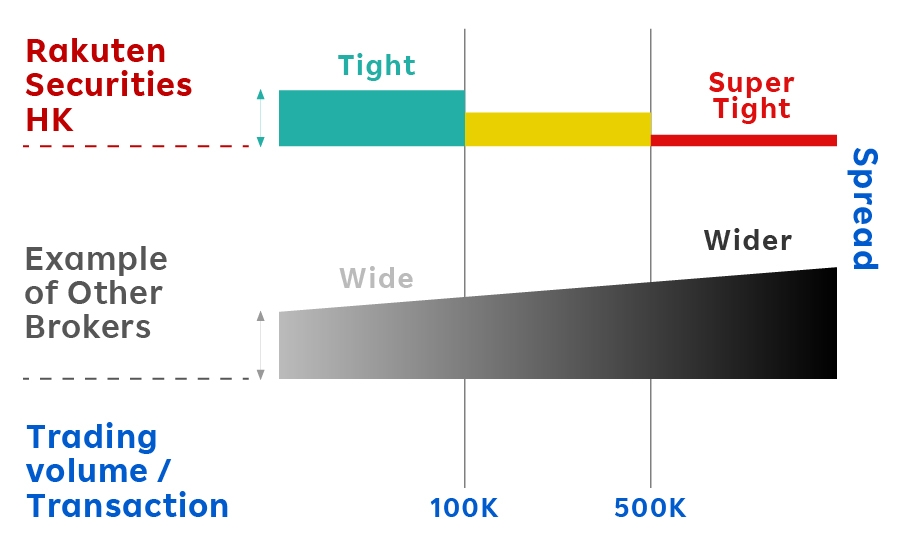

What if we compare with other brokers?

You can save more costs with us when placing a large transaction with our volume-based ladder spreads as some other brokers charge higher pips for large transactions!

Taking AUD/USD as an example:

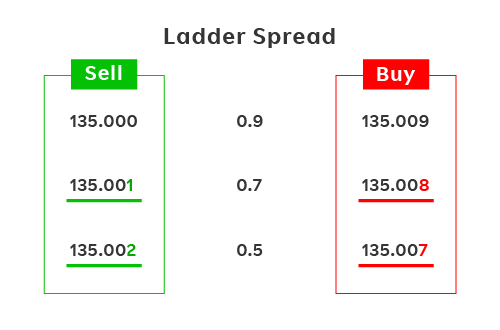

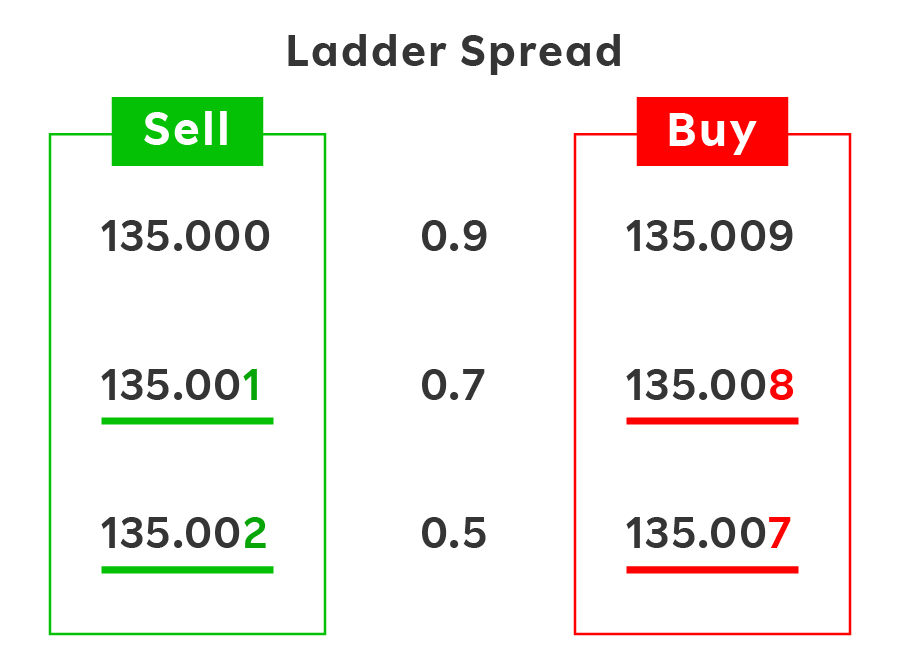

Price distribution of volume-based ladder spreads

The discounted spread will be started tightening by the sequence of “Sell” and then “Buy”.

E.g. Price of USD/JPY

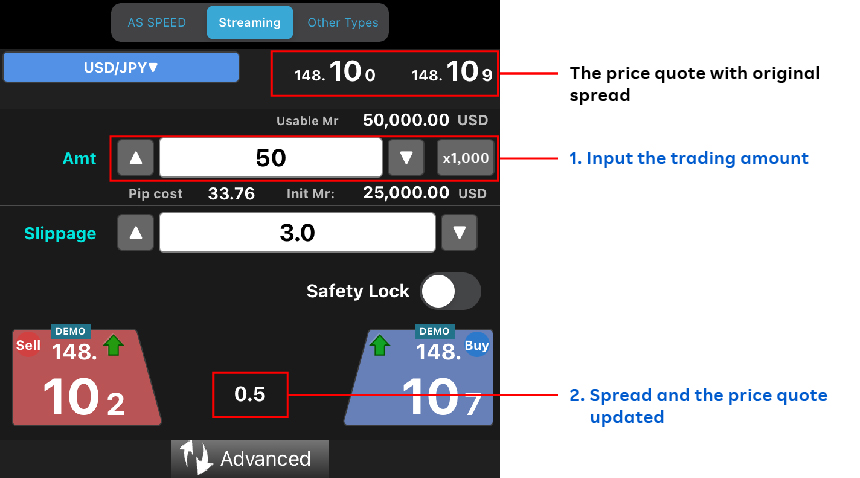

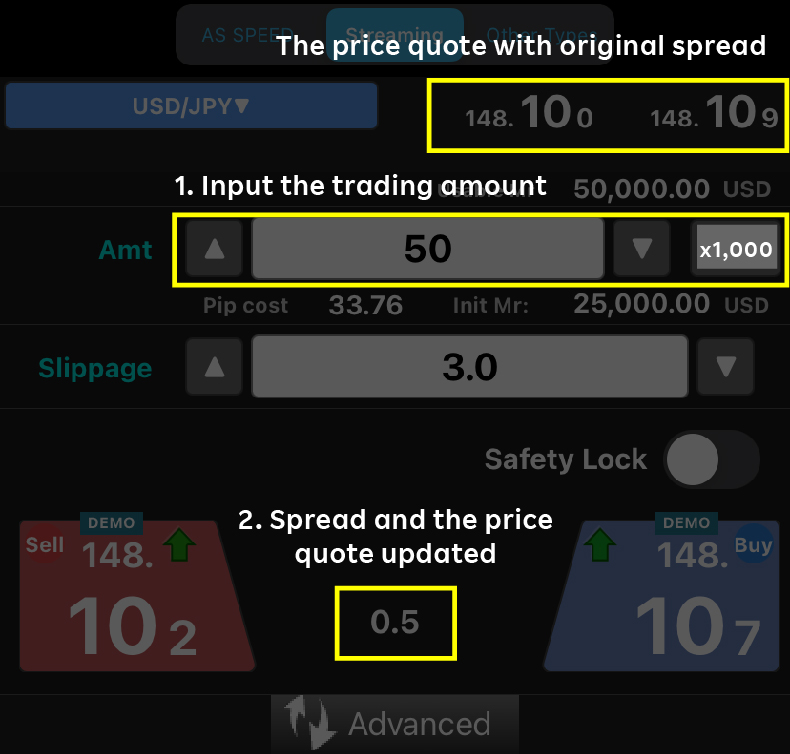

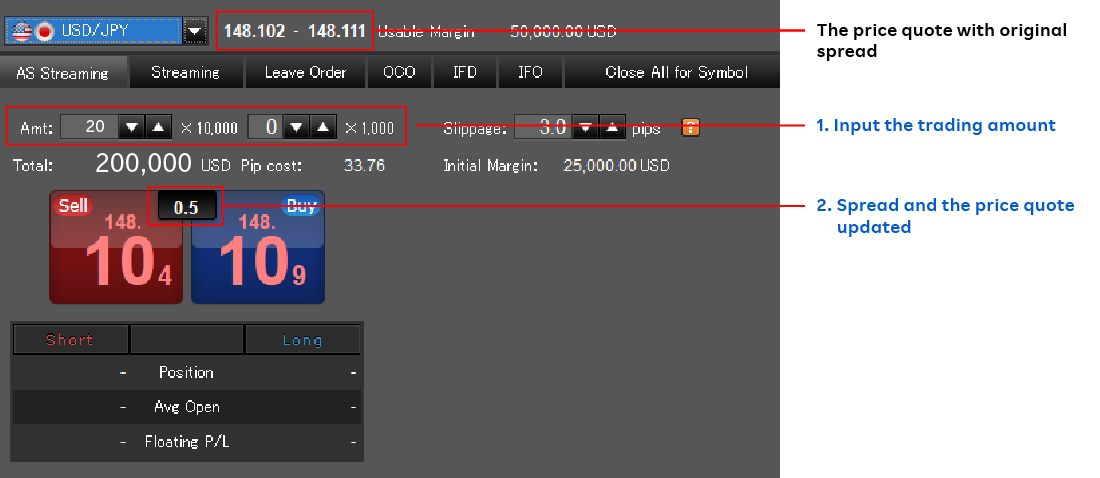

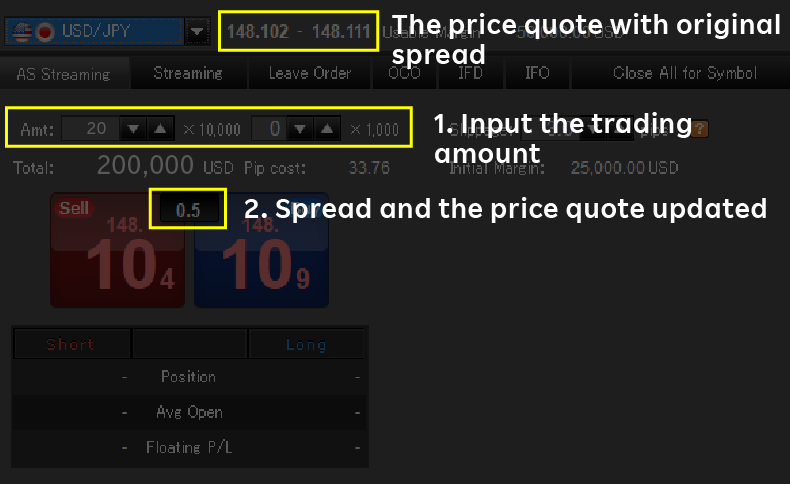

How to enjoy the volume-based ladder spreads?

You can input the trading amount and the updated spread will be shown on the order screen.

Mobile (iSPEED FX)

Desktop (MARKETSPEED FX)

Order types applicable to the volume-based ladder spreads

Order Types | Is it applicable? |

|---|---|

Streaming | |

AS Streaming | |

AS SPEED | |

Leave Order | X |

Note: Positions of loss cut or auto liquidation by Rakuten Securities HK cannot enjoy the volume-based ladder spreads.

Examples:

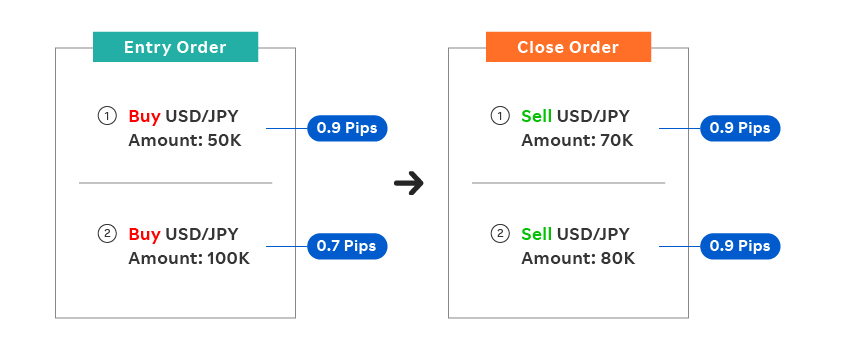

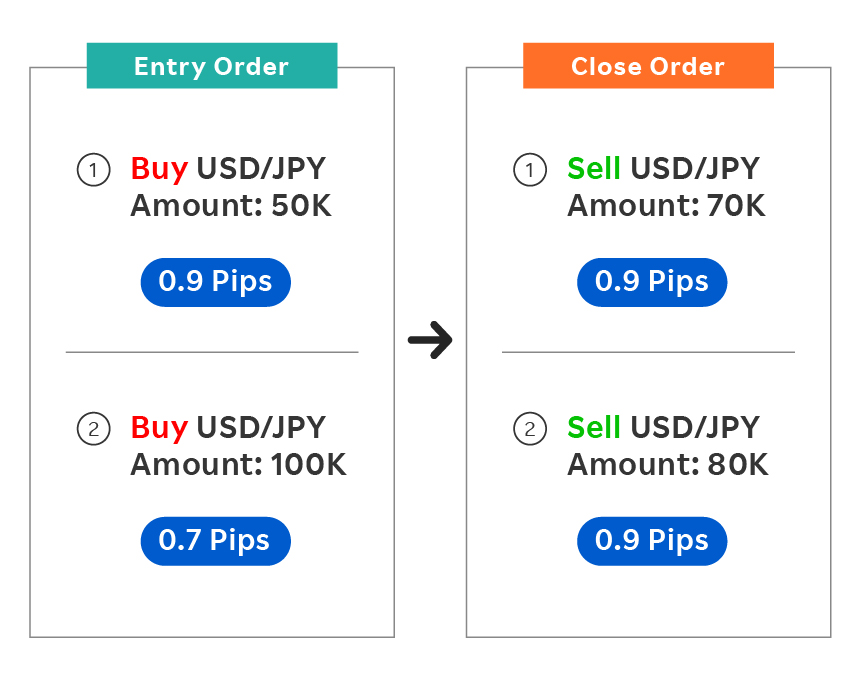

- The volume-based ladder spreads are applied according to the transaction size of each order.

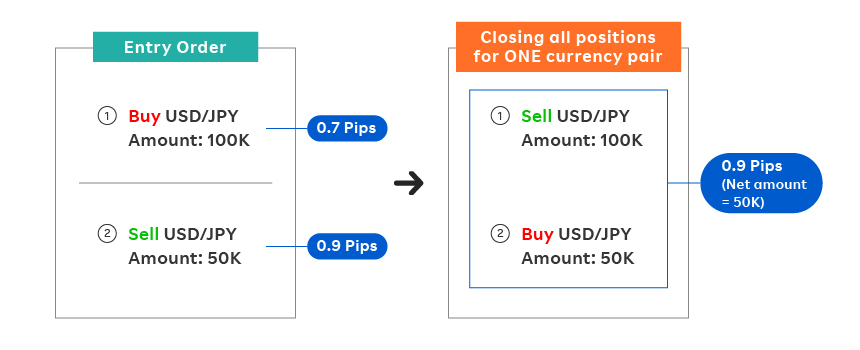

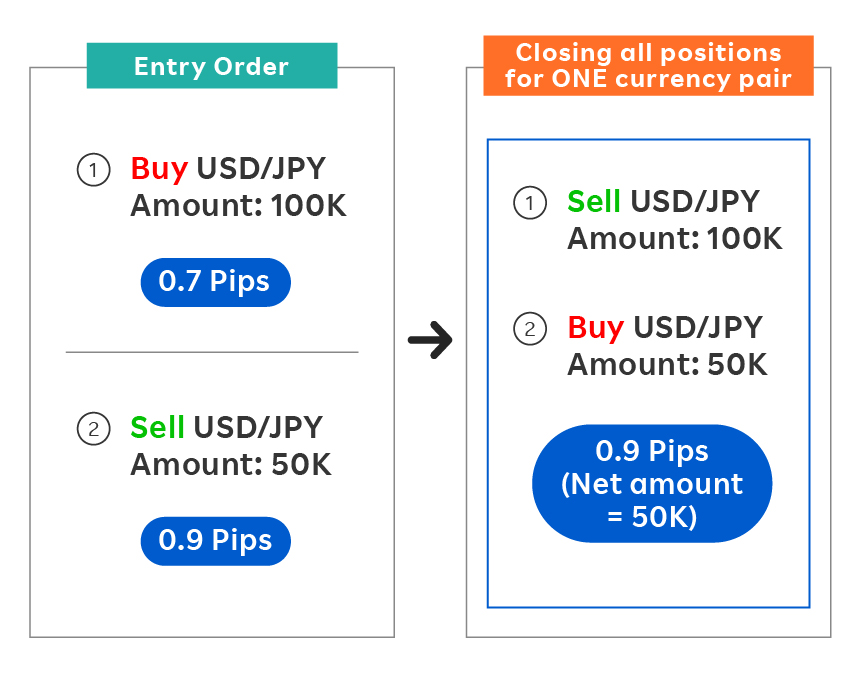

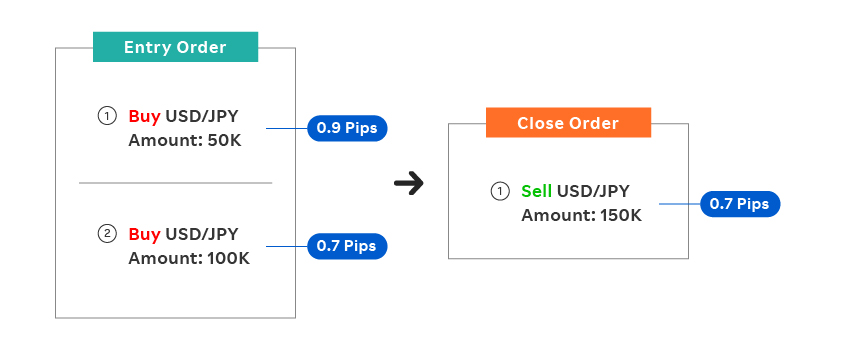

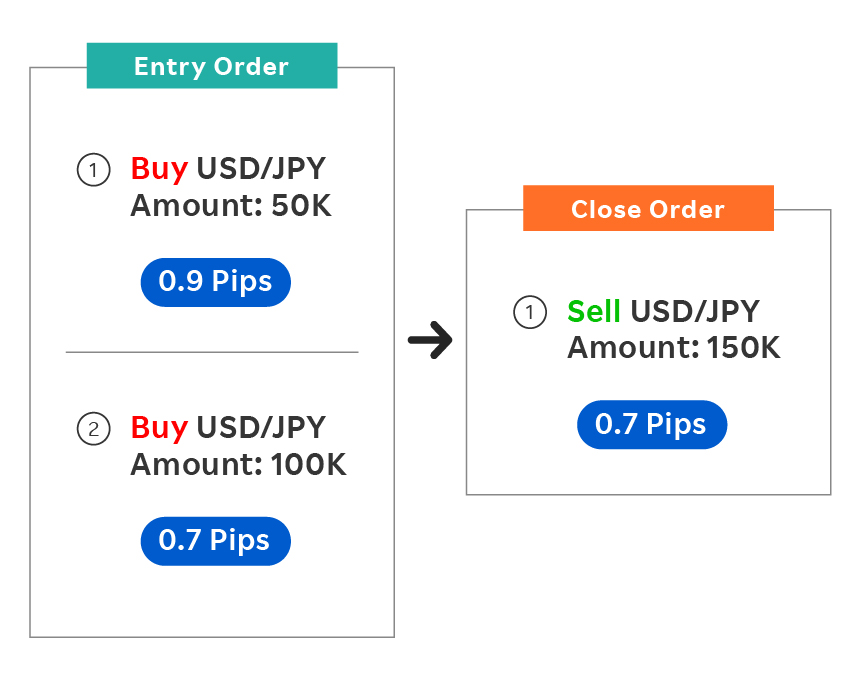

Case 1: Entry at different sizes & close together

Case 2: Entry at different sizes & close separately

2. If “Close All” function is used for closing all positions for one currency pair, all the order amount will be counted as net amount.