Quick Quote

Real-Time Quick Forex Quotes

The live forex quotes of Rakuten Securities Hong Kong provides investors with real-time pricing data for a comprehensive range of currency pairs as below. This enables them to execute trades at favorable exchange rates, profiting from the price difference.

What Are Real-Time Forex Quotes?

Real-time forex quotes refer to the latest exchange rates of one currency against another in the global forex market. As the forex market operates globally and trades 24 hours a day, exchange rates have the potential to change at any time; thus, live forex quotes are continuously updated. The live forex quotes table lists the buying and selling prices of each currency pair, the spread between them, the latest exchange rate compared to yesterday’s closing price, and overnight interest rate data. The latest data for different currency pairs are clearly displayed in the live forex quotes table, showing the latest exchange rates and trends.

Why Do Investors Need to Refer to Foreign Exchange Live Quotes?

Referring to forex life quotes is crucial for investors because live forex quotes are the most direct indicators reflecting the latest market conditions in the forex market. By referencing foreign exchange live quotes, investors can understand the latest trends in the forex market. For example, from live forex quotes, investors can identify currency pairs with potential for appreciation and timely purchase of currencies to seize profit opportunities. In addition, investors can also identify currency pairs with declining trends on the quotes table and sell the currencies they hold promptly, effectively managing risks.

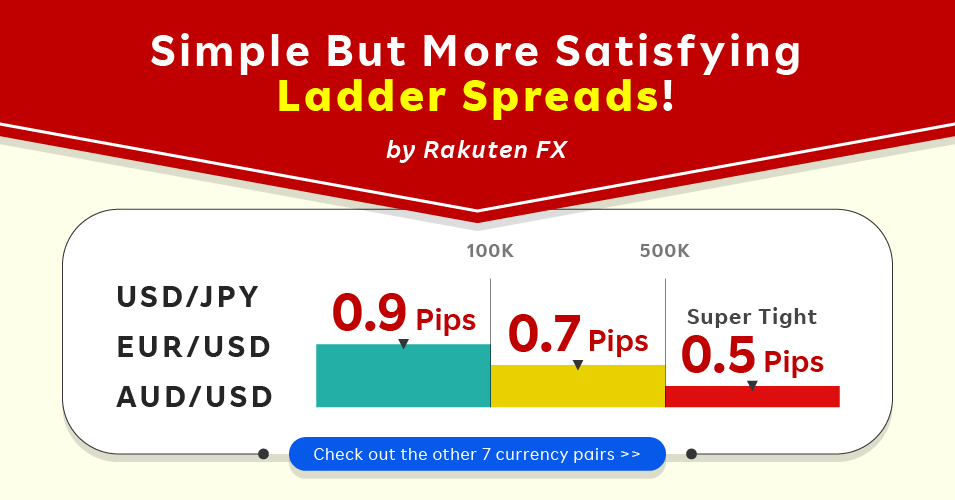

Volume-based ladder spreads are applied for USD/JPY, EUR/USD, AUD/USD, GBP/USD, NZD/USD, EUR/JPY, USD/CAD, AUD/JPY, GBP/JPY, and USD/CHF. More details >

Real-Time Forex Quotes

| Currency exchange | Sell | Buy | Spread | Difference(Closing price) | Roll Trading volume: per 10K Currency: HKD |

|

|---|---|---|---|---|---|---|

| Sell | Buy | |||||