Rakuten FX Order Type

Let’s check out the 7 popular order types in Rakuten FX to help you trade!

Order Type | Features | |

|---|---|---|

1 | Streaming | Placing trades through Streaming enables you to place trade by clicking on live rate panels. With hedging function, you can open two orders in opposite direction at the same time. |

2 | AS Streaming | “AS” means “Auto Select”. AS Streaming enables orders executed immediately without setting Entry or Close. You can trade more speedily. No hedging function. Once AS Streaming order is submitted, open position(s) in the opposite direction will be closed automatically. |

3 | AS SPEED | Similar with AS Streaming and can show both real-time price rate and chart simultaneously. (Only available on iSPEED FX) |

4 | Leave Order | Leave Order is either to buy or sell a currency pair at a specific price. The most common types of Leave Order are “Limit Order” and “Stop Order”. Decide Entry Price WITHOUT Stop Loss (SL) / Take Profit (TP). |

5 | IFD | “IFD” means “If Done”. You can place entry order and close order at the same time. If the entry order part is executed, the close order part will be activated accordingly. Need to decide 2 prices: 1. Entry price, 2. Stop Loss (SL) or Take Profit (TP). |

6 | OCO | “OCO” means “One cancel the other order”. You can place 2 entry orders or 2 close orders at the same time. Once the market reaches one side, the remaining side will be cancelled automatically.

4 combinations: 1. S/S: SELL below Market price, SELL above Market price 2. B/B: BUY above Market price, BUY below Market price 3. Limit (S/B): BUY below Market price, SELL above Market price 4. Stop (S/B): BUY above Market price, SELL below Market price |

7 | IFO | “IFO” is a combination of an IFD and an OCO order, which means setting an IFD entry order and 2 corresponding OCO close orders. Need to decide 3 prices (full set of pending order): 1. Entry price, 2. Stop Loss (SL), 3. Take Profit (TP). |

1. Streaming

Placing trades through Streaming enables you to place trade by clicking on live rate panels.

Just like below table, if you click order “Sell” with streaming, the sell order will be executed at the price of 1.04061.

With hedging function, trader can open two orders in opposite direction at the same time.

For example, if you already had a buy order of 1,000 EUR/USD at 1.04100, and would like to hedge with a sell order, you can use streaming to place a sell order with same amount of EUR/USD at 1.04061. Finally, you will have two orders in open position:

1,000 EUR/USD Buy at 1.04100

1,000 EUR/USD Sell at 1.04061

Currency exchange | Sell | Buy |

|---|---|---|

EUR/USD | 1.04061 | 1.04066 |

2. AS Streaming

“AS” means “Auto Select”. When an order is placed, the system will automatically select for order entry or order close. You can trade more speedily.

AS Streaming supports different sequence of closing position e.g., FIFO, LIFO, P/L Loss, P/L Profit. You can change your setting at “AS Streaming Settings”.

- FIFO (First in First out)

This is the default setting of AS Streaming, first opened positions will be closed first. - LIFO (Last in First out)

The last opened positions will be closed first. - P/L Loss

The position with greater loss per trading unit (or lesser profit per trading unit) will be closed first.

(Swap P/L is not included in this calculation) - P/L Profit

The position with greater profit per trading unit (or lesser loss per trading unit) will be closed first.

(Swap P/L is not included in this calculation)

No hedging function. Once AS Streaming order is submitted, open position(s) in the opposite direction will be closed automatically.

For example, if you already had a buy order of 1,000 EUR/USD at 1.04100 and using AS streaming to place a sell order with same amount of EUR/USD at 1.04061, the buy order at 1.04100 will be automatically closed at 1.04061.

3. AS SPEED

Similar with AS Streaming and can show both real-time price rate and chart simultaneously. You can manage the open position by checking the average rates, floating P/L, usable margin, etc. in a single window.

(Only available on mobile app: iSPEED FX)

4. Leave Order

Leave Order is either to buy or sell a currency pair at a specific price. The most common types of Leave Order are “Limit Order” and “Stop Order”.

- Limit

To ‘Buy’ a “Limit Order” is to place an order below the current market price. To ‘Sell’ a “Limit Order” is to place an order above the market price.

For example,

Current EUR/USD market price: 1.04066

Order: Buy EUR/USD if market price drops to 1.04050 - Stop

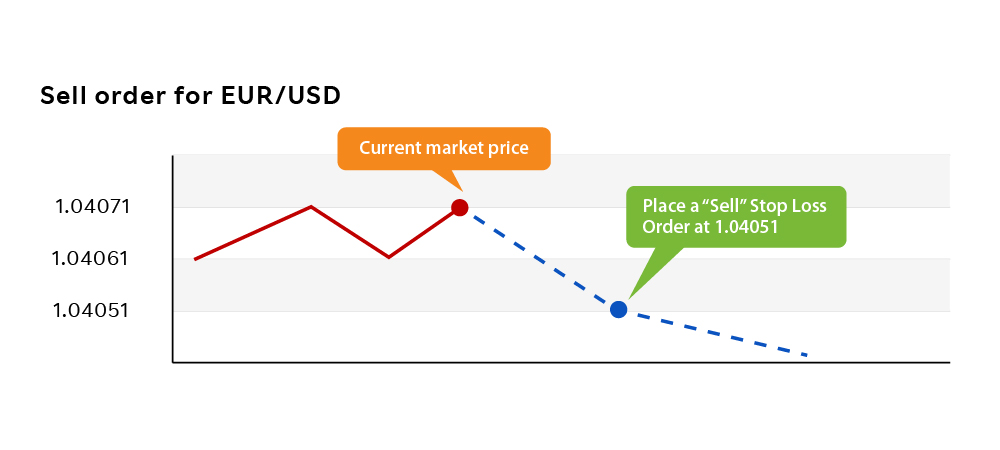

To ‘Buy’ a “Stop Order” is to place trade above the current market price. To ‘Sell’ a “Stop Loss Order” is to place order below the market price.

For example, place a “Sell” “Stop Loss Order” at 1.04051 when the current market price is 1.04071. If the market price drops to 1.04051, the order will be executed.

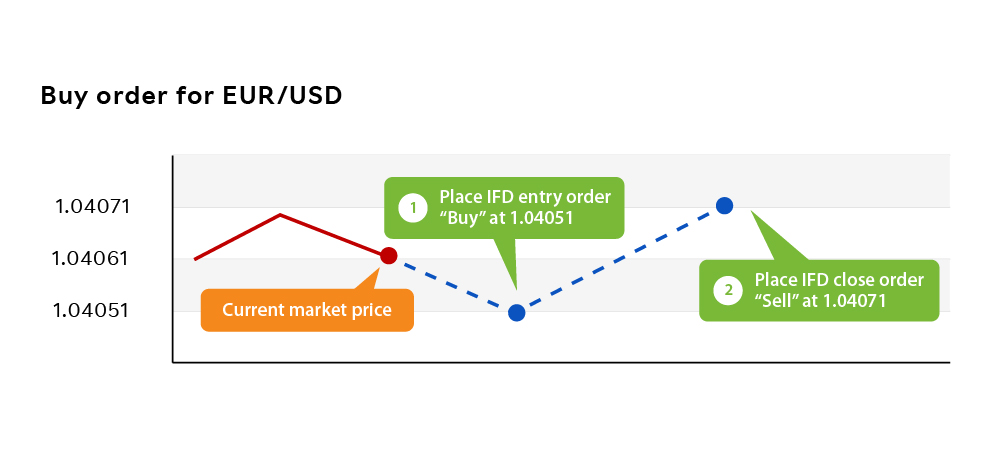

5. IFD

“IFD” means “If Done”. You can place entry order and close order at the same time. If the entry order part is executed, the close order part will be activated accordingly.

For example,

When the current market price of EUR/USD at 1.04061, place an IFD entry order “Buy” at 1.04051 and close order “Sell” at 1.04071. If the market price drops to 1.04051, the entry order (1) will be executed and the close order (2) will be activated.

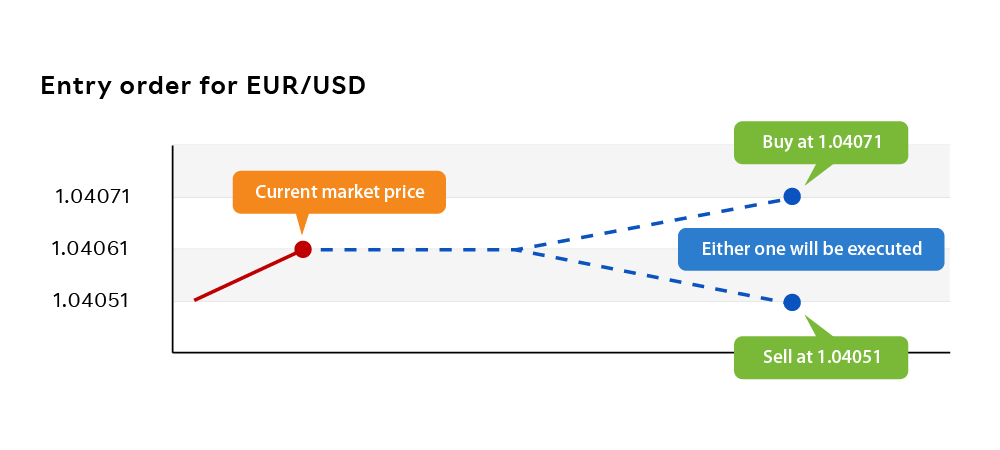

6. OCO

“OCO” means “One side done then cancel the other order”. You can place 2 entry orders or 2 close orders at the same time. Once the market reaches one side, the remaining side will be cancelled automatically.

OCO is helpful when you want to decide to sell or buy depending on the market situation. Also, if you use OCO when close order, you can set stop loss and profit taking order at the same time.

For example,

When the current market price of EUR/USD at 1.04061, place an OCO “Buy” order at 1.04071 and “Sell” order at 1.04051.

- If price of EUR/USD increases to 1.04071, the “Buy” order will be executed and the “Sell” order will be cancelled automatically.

or

- If price of EUR/USD decreases to 1.04051, the “Sell” order will be executed and the “Buy” order will be cancelled automatically.

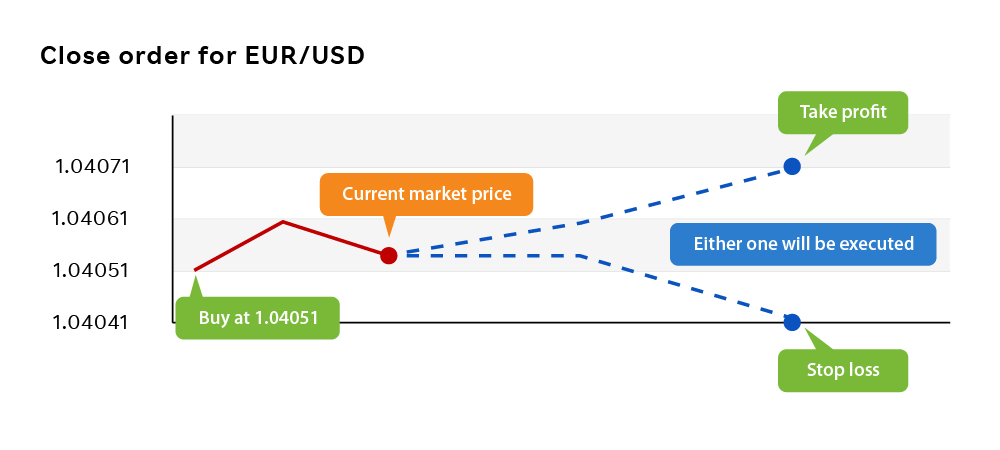

For example,

After open a “Buy” order of EUR/USD at 1.04051, place an OCO “Sell” order at 1.04071 to take profit and “Sell” order at 1.04041 to stop loss. Either one will be executed, and another order will be cancelled automatically.

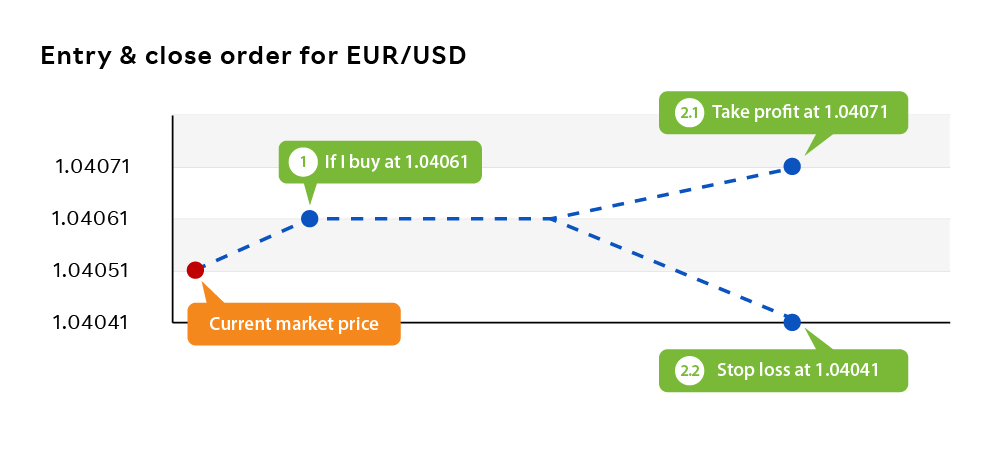

7. IFO

“IFO” is a combination of an IFD and an OCO order, which means setting an IFD entry order and 2 corresponding OCO close orders. Once the IFD entry order is executed, 2 OCO close orders will be activated accordingly, but only one side of an OCO order will be executed, the remaining order will be cancelled automatically.

For example,

Place an IFD entry order at 1.04061 and two OCO close orders at 1.04071 and 1.04041.

After the entry order (1) is executed, then the two OCO (2- 1 and 2-2) will be activated.

- 2-1) The order will be closed at either 1.04071 (take profit)

or

- 2-2) at 1.04041 (Stop loss)